Utilizing a pre-designed structure offers several advantages. It streamlines the borrowing process, saving applicants time and effort. The standardized format ensures all necessary information is provided, reducing the likelihood of delays caused by incomplete applications. Lenders benefit from a consistent data format, which simplifies their review and decision-making processes. This can lead to faster loan approvals and ultimately, a smoother borrowing experience.

Understanding the components and function of such a structure is crucial for both borrowers and lenders. The following sections will explore the key elements typically included in these documents, best practices for completion, and how they contribute to the overall loan approval process.

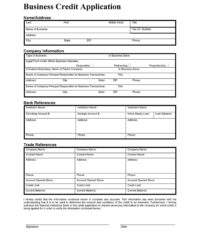

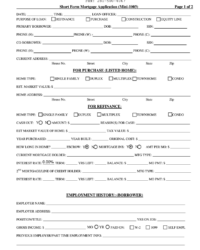

Key Components of a Typical Application for Borrowing Funds

Several key data points are typically required within applications for consumer financing. Understanding these components is essential for both borrowers and lenders to ensure a smooth and efficient application process.

1. Personal Information: This section collects identifying information such as the applicant’s full legal name, date of birth, social security number, current address, and contact details. Accurate and complete information is crucial for verification purposes.

2. Employment History: Details regarding current and previous employment are typically requested. This includes the name and address of employers, dates of employment, job titles, and income information. Stable employment history is a significant factor in loan approval decisions.

3. Income Verification: Applicants are often required to provide documentation to verify their stated income. This may include pay stubs, tax returns, or bank statements. Verification ensures the lender has an accurate understanding of the applicant’s repayment capacity.

4. Loan Details: The specific loan parameters are outlined in this section, including the desired loan amount, purpose of the loan, and preferred repayment terms. Clearly stating the intended use of funds can strengthen the application.

5. Asset and Liability Information: A comprehensive overview of the applicant’s financial standing is required. This includes details of assets, such as real estate, vehicles, and investments, as well as liabilities, such as outstanding loans, credit card debt, and mortgages. This information provides a complete picture of the applicant’s financial health.

6. Credit Authorization: Applicants typically grant permission for the lender to access their credit report. This allows the lender to assess creditworthiness and determine the applicant’s credit risk.

Accurate and complete information across these areas facilitates a thorough evaluation of creditworthiness and ultimately contributes to efficient and informed lending decisions.

How to Create a Standardized Borrowing Form

Creating a standardized borrowing form requires careful consideration of various elements to ensure completeness and efficacy in facilitating lending decisions. The following steps outline the process of developing such a document.

1. Define the Purpose: Clearly establish the specific type of loan the form is intended for (e.g., personal loan, auto loan, mortgage). This ensures the relevant information is captured for accurate assessment.

2. Gather Essential Information Fields: Include fields for personal identification, employment history, income verification, loan details, asset and liability information, and credit authorization. These elements provide a comprehensive view of the applicant’s financial profile.

3. Structure for Clarity and Flow: Organize the form logically, grouping related information together. Clear headings and concise instructions improve user experience and reduce errors during completion.

4. Ensure Compliance and Accuracy: Adhere to all relevant legal and regulatory requirements. Accurate calculations and clear disclaimers are crucial for transparency and legal validity.

5. Offer Accessible Formats: Provide the form in accessible formats (e.g., online, printable PDF) to cater to diverse applicant needs and preferences. User-friendly design enhances accessibility.

6. Test and Refine: Before widespread implementation, conduct thorough testing to identify and address any potential usability issues or areas for improvement. Feedback from users can be invaluable during this stage.

7. Implement Security Measures: Protect sensitive data by incorporating appropriate security measures, such as encryption and secure storage solutions, into online forms and databases.

8. Maintain Current Information: Regularly review and update the form to reflect changes in regulations, lending practices, or internal policies. Keeping information current ensures ongoing compliance and efficacy.

A well-designed form provides a standardized framework for collecting necessary data, ensuring efficiency and consistency in the loan application process. Careful attention to these steps results in a more effective tool for both borrowers and lenders.

Standardized forms for borrowing funds play a crucial role in the modern lending landscape. They provide a structured framework for collecting essential applicant data, facilitating efficient processing and analysis by lending institutions. A well-designed template ensures consistency, reduces errors, and streamlines the application process for both borrowers and lenders. Understanding the key components, best practices for completion, and the importance of accurate data contributes to informed lending decisions and a more efficient borrowing experience. Security measures and regular updates are crucial for maintaining the integrity and effectiveness of these crucial financial instruments.

Leveraging technology and data-driven insights, the evolution of these documents will continue to shape the future of lending. As financial technology advances, further streamlining and automation are likely, enabling faster processing and more personalized lending experiences. Embracing these advancements while prioritizing data security and ethical considerations will be essential for fostering a responsible and efficient lending ecosystem.