Utilizing a pre-designed structure offers several advantages. It streamlines the process for applicants, ensuring all required information is provided. This reduces the likelihood of delays caused by incomplete submissions. Furthermore, it allows lenders to compare applications consistently, promoting fair and objective decision-making. Standardized forms also contribute to greater transparency and efficiency in the overall lending process.

This foundation of understanding paves the way for a deeper exploration of related topics, such as specific requirements for different loan types, strategies for completing the forms effectively, and navigating the loan approval process successfully.

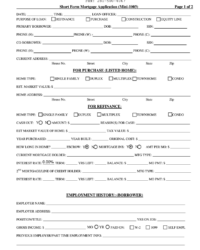

Key Components of a Loan Application

A comprehensive application is crucial for securing financing. Several key elements enable lenders to assess risk and make informed decisions.

1. Personal Information: This section typically requests details such as full name, address, contact information, date of birth, and social security number. Accurate and complete information is essential for verification purposes.

2. Financial Information: Applicants are generally required to disclose details about their income, assets, liabilities, and credit history. This information provides insight into an individual’s ability to repay the loan.

3. Loan Details: The desired loan amount, purpose, and repayment terms are typically specified in this section. Clearly outlining these details helps lenders understand the applicant’s needs and assess the suitability of the loan.

4. Employment History: Information about current and previous employment, including employer names, dates of employment, and income earned, demonstrates stability and income potential.

5. Collateral (if applicable): For secured loans, details about the asset being used as collateral, such as its value and ownership status, are required. This provides security for the lender in case of default.

6. Business Information (if applicable): For business loans, details about the business, including its legal structure, financial performance, and ownership, are necessary to evaluate the business’s creditworthiness.

Providing complete and accurate information across these key areas increases the likelihood of a successful application outcome. A thorough application allows lenders to assess the level of risk involved and determine the appropriate loan terms.

How to Create a Bank Loan Application Template

Developing a standardized loan application form requires careful consideration of various factors to ensure completeness and clarity. The following steps outline the process of creating a robust and effective template.

1: Define the Loan Purpose: Specify the intended use of the loan (e.g., personal, business, mortgage). This clarifies the information requirements specific to the loan type.

2: Gather Required Information: Determine the essential data points needed to assess applicant eligibility and risk. This typically includes personal, financial, employment, and loan-specific details.

3: Structure the Template: Organize the information logically into sections. Clear headings and subheadings enhance readability and ensure all necessary data is captured systematically.

4: Use Clear and Concise Language: Employ straightforward language to avoid ambiguity and ensure applicants understand the questions. Instructions should be clear and easy to follow.

5: Include Disclosures and Consent Clauses: Incorporate necessary legal disclosures and obtain consent for information verification and processing. This ensures compliance with relevant regulations.

6: Test and Refine: Pilot test the template with potential applicants to identify any areas for improvement. Feedback can enhance usability and ensure the template effectively captures the required information.

7: Ensure Accessibility: Make the template accessible to individuals with disabilities. Consider formatting requirements and alternative formats for those with visual or other impairments.

A well-designed template facilitates efficient processing, reduces errors, and ensures fairness and transparency in lending practices. A systematic approach to template creation, incorporating these key elements, leads to a more effective and user-friendly application process.

Standardized forms provide a crucial framework for lending institutions and loan seekers. These structured documents ensure consistent data collection, facilitate efficient processing, and promote transparency in loan applications. Understanding the key components of these forms, including personal and financial information, loan details, and supporting documentation, is essential for both applicants and lenders. Effective forms benefit both parties by streamlining the application process, reducing errors, and enabling informed decision-making.

Careful design and implementation of these templates contributes significantly to a more efficient and equitable lending ecosystem. As financial landscapes evolve, the role of structured application processes will continue to be critical in ensuring access to capital and fostering responsible financial practices.