Using a succinct format offers several advantages. It saves time for both the applicant and the lender, streamlining the initial stages of the credit application process. A well-structured, single-page format also presents a professional image, reflecting organizational skills and a clear understanding of the required information. Moreover, it can improve the chances of approval by ensuring all essential details are readily available and easy to review.

The subsequent sections will delve deeper into the specific components of this essential document, offering guidance on how to effectively complete each section and maximize the likelihood of securing needed credit. Further topics will cover best practices for submission and strategies for navigating the subsequent steps in the credit approval process.

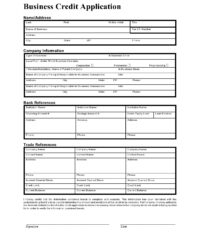

Key Components

A comprehensive, yet concise, credit application requires specific data points for effective evaluation. These components provide a lender with the necessary information to assess risk and make informed decisions.

1. Business Identification: This section typically includes the legal business name, address, contact information, and federal tax identification number. It establishes the basic identity of the applicant business.

2. Business Structure and History: Details regarding the date of establishment, legal structure (e.g., sole proprietorship, LLC, corporation), and a brief description of the business activities are crucial for understanding the nature and stability of the enterprise.

3. Ownership Information: Identifying the owners, including their names and percentage of ownership, provides transparency and allows for further due diligence if necessary.

4. Financial Information: This section is critical and often includes annual revenue, profit margins, and existing debt obligations. Bank account details and trade references may also be requested.

5. Credit Request Details: Specifying the desired credit amount, intended use of funds, and preferred repayment terms is essential for the lender to evaluate the purpose and feasibility of the credit request.

6. Banking Relationships: Information about current banking relationships, including bank name, account numbers, and contact information, allows lenders to assess existing financial management practices.

Accurate and complete information within each component is paramount for a successful application. Omissions or inconsistencies can delay processing or even lead to rejection. Therefore, careful preparation and review are highly recommended before submission.

How to Create a One-Page Business Credit Application

Developing a streamlined credit application requires careful planning and organization. A well-structured document enhances clarity and professionalism, increasing the likelihood of a favorable outcome.

1. Define Objectives: Clearly outline the purpose and desired outcome of the credit application. Understanding the specific credit needs is fundamental to crafting an effective document.

2. Gather Essential Information: Compile all necessary data points before starting the design process. This includes business identification details, financial records, ownership information, and banking relationships.

3. Choose a Template or Software: Utilizing a pre-designed template or software can significantly expedite the process and ensure a professional layout. Numerous options are available online or through business software suites.

4. Structure the Layout: Organize the information logically, using clear headings and concise language. Prioritize essential information and ensure readability.

5. Populate the Template: Accurately and completely fill in all required fields within the chosen template. Double-check all entries for accuracy and consistency.

6. Review and Refine: Thoroughly review the completed application for any errors or omissions. Seek feedback from colleagues or advisors to ensure clarity and completeness.

7. Maintain a Professional Tone: Use clear, concise language and avoid jargon. A professional tone conveys credibility and reinforces the seriousness of the application.

8. Prepare Supporting Documentation: Gather any necessary supporting documents, such as financial statements or bank records. Having these readily available can expedite the approval process.

A meticulously crafted application demonstrates preparedness and professionalism, contributing significantly to a positive credit assessment. Attention to detail and accurate information are crucial for conveying creditworthiness and securing necessary funding.

A concise credit application provides a crucial tool for businesses seeking financial resources. Streamlining the process through a single, comprehensive document facilitates efficient review by lenders while projecting a professional image for the applicant. Careful attention to the key components, accurate data entry, and a well-organized presentation significantly enhance the likelihood of approval. This document serves as a cornerstone of the credit acquisition process, enabling businesses to effectively communicate their financial needs and creditworthiness.

Securing necessary funding is often a critical step in business growth and development. A well-crafted application demonstrates preparedness and professionalism, setting the stage for a successful lending relationship. Thorough preparation and attention to detail in this initial phase can significantly impact long-term financial outcomes, enabling businesses to access the capital required to achieve their strategic objectives.