Utilizing such a form offers several advantages. It reduces the likelihood of overlooking critical information, expedites credit decisions, and promotes fairness and transparency in the evaluation process. For businesses seeking credit, a well-prepared submission enhances their credibility and professionalism. For creditors, it simplifies analysis and risk assessment, ultimately contributing to more informed and efficient decision-making.

credit

Commercial Credit Application Template

Utilizing such a form offers several advantages. It saves time and resources for both the applicant and the lender, reduces the likelihood of errors or omissions, and promotes transparency by clearly outlining the required information. This structured approach facilitates a quicker and more efficient credit evaluation process, ultimately benefiting both parties involved in the transaction.

Blank Credit Application Template

Providing potential borrowers with an empty form offers several advantages. It allows them to gather the necessary information in advance, ensuring a smoother and more efficient application process. Access to the form beforehand also enables applicants to review the requirements and understand the lender’s expectations, leading to more complete and accurate submissions. This preparedness can improve the chances of application approval and contribute to a more positive borrowing experience.

Basic Credit Application Template

Utilizing a pre-designed structure streamlines the application process for both borrowers and lenders. It reduces the likelihood of missing crucial information, accelerates processing time, and facilitates objective comparison across applicants. This standardized approach also promotes transparency and clarity in lending decisions.

Credit Card Application Template

Utilizing a pre-designed structure offers several advantages. It reduces the likelihood of errors or omissions, ensuring completeness and accuracy. This, in turn, expedites processing times, leading to faster decisions. Furthermore, a standardized format contributes to a more efficient and organized system for managing applications, benefiting financial institutions by optimizing their workflow.

Credit Application Template For Business

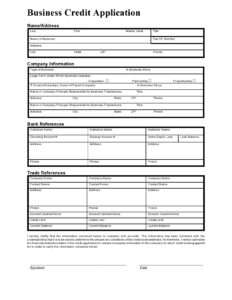

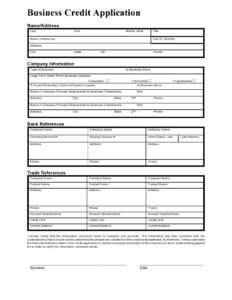

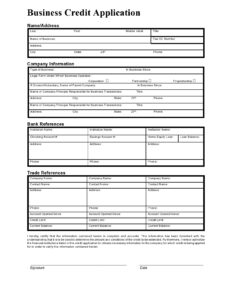

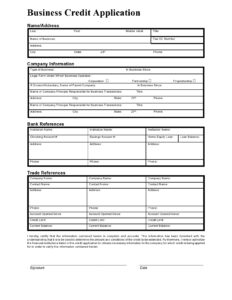

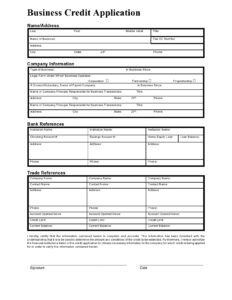

Utilizing such a standardized form offers several advantages. It ensures all necessary information is collected, reducing the likelihood of overlooked details and minimizing back-and-forth communication. This efficiency saves time and resources for both the applicant and the extending company. Moreover, consistent data collection allows for objective comparisons between applicants and contributes to fairer credit evaluations. Finally, a well-designed form can project professionalism and build trust with potential customers.

Corporate Credit Application Template

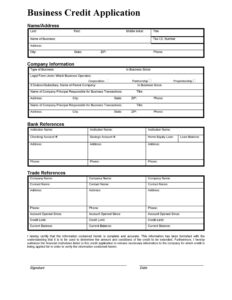

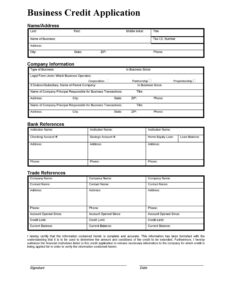

Streamlined data collection and processing leads to faster credit decisions. A standardized format minimizes errors and omissions, reducing the need for back-and-forth communication between the applicant and the lender. This efficiency saves time and resources for both parties, contributing to a smoother credit application experience. Furthermore, having all necessary information readily available allows businesses to present a comprehensive financial picture, potentially strengthening their creditworthiness.

Business To Business Credit Application Template

Utilizing a pre-designed structure for credit evaluations offers several advantages. It ensures consistency in data collection, simplifying comparisons between applicants. This standardized approach reduces processing time and improves efficiency in credit assessments. Furthermore, it aids in compliance with regulatory requirements and fosters a professional image for the supplying company.

Business Credit Application Template

Credit One Bank Letterhead Template

Credit One Bank offers a variety of letterhead templates that can be downloaded for free from their website. These templates are available in a variety of formats, including Microsoft Word, PDF, and HTML.