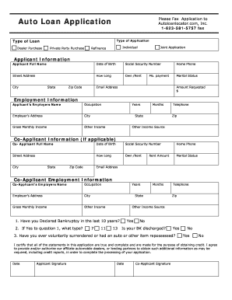

Utilizing a standardized form offers numerous advantages. It ensures all necessary information is gathered, reducing processing time and potential errors. This efficiency benefits both the applicant and the lender. Furthermore, a well-designed form can contribute to a more transparent and equitable lending process.

credit

Supplier Credit Application Template

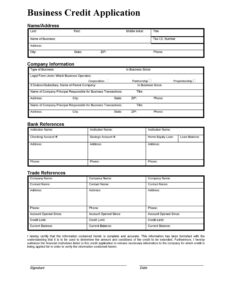

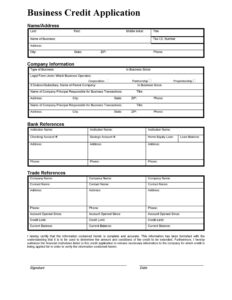

Utilizing such a form offers numerous advantages. It ensures consistent data collection, simplifies credit evaluations, and reduces the risk of errors or omissions. For applicants, it provides a clear framework for presenting their financial information, improving the chances of securing favorable credit terms. For suppliers, it facilitates efficient credit management and contributes to informed decision-making.

Submit Credit Application Template

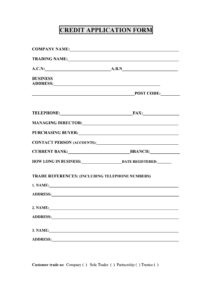

Utilizing pre-designed forms offers several advantages. Standardization streamlines the application review process, allowing for efficient processing and faster decision-making. Clear and organized data presentation facilitates a thorough understanding of the applicant’s financial standing. Furthermore, standardized forms promote fairness and transparency by ensuring all applicants provide the same information, allowing for objective and equitable evaluation.

Simple Credit Application Template

Utilizing a pre-designed structure offers several advantages. It reduces the likelihood of missing crucial information, leading to quicker processing times. Standardized formats allow for easier comparison across applicants and facilitate automated assessments. This streamlined approach also benefits applicants by providing a clear and concise method for presenting their financial standing.

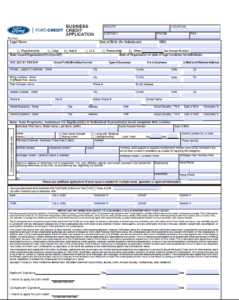

Sample Business Credit Application Template

Utilizing a pre-designed form offers several advantages. It allows businesses to anticipate the necessary information, ensuring they have all required documentation prepared in advance. This proactive approach streamlines the application process, saving time and reducing the likelihood of delays or rejections due to incomplete submissions. Furthermore, it can help businesses present their financial information in a clear and organized manner, enhancing their credibility with potential lenders.

One Page Business Credit Application Template

Using a succinct format offers several advantages. It saves time for both the applicant and the lender, streamlining the initial stages of the credit application process. A well-structured, single-page format also presents a professional image, reflecting organizational skills and a clear understanding of the required information. Moreover, it can improve the chances of approval by ensuring all essential details are readily available and easy to review.

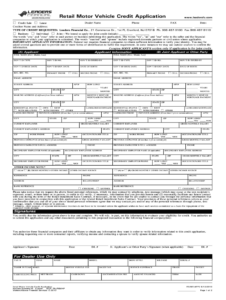

Dealer Credit Application Template

Utilizing a structured form offers several advantages. It reduces the likelihood of missing critical information, expedites loan processing times, and contributes to a more professional and organized approach to customer interactions. This efficiency benefits both the business and the customer, leading to smoother transactions and potentially quicker approvals.

Dealer Blue Credit Application Template

Utilizing a pre-designed structure offers advantages to both dealerships and customers. Dealers benefit from reduced administrative overhead and improved compliance with lending requirements. Customers experience a simplified and more transparent application process, potentially leading to quicker purchase approvals and a smoother overall buying experience. Standardized forms can also contribute to greater accuracy and completeness in submitted information, minimizing potential delays.

Customer Credit Application Template Australia

Utilizing pre-designed formats offers several advantages. Businesses benefit from improved efficiency in processing applications and reduced administrative overhead. Applicants experience a more transparent and user-friendly process, understanding clearly the information required. Consistent data collection also supports more informed credit assessments and facilitates better risk management.

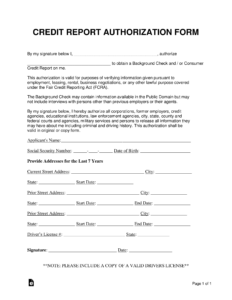

Credit Report Application Template

Utilizing a pre-designed structure offers several advantages. It simplifies the application process, reduces the likelihood of errors, and ensures consistency in data submission. This streamlined approach can save valuable time and effort for both the applicant and the credit bureau. Furthermore, using a standard form helps maintain compliance with data protection regulations and ensures requests are processed securely.