Utilizing a pre-designed structure offers several advantages. It streamlines the application process for both the applicant and the reviewing entity. The organized nature of the form allows applicants to clearly articulate their needs, while reviewers can assess requests consistently and fairly based on the provided data. This structured approach reduces processing time and ensures objective evaluation, enabling faster delivery of necessary aid. Moreover, it can reduce stress for applicants by providing a clear pathway to seek support.

The following sections will explore the key components of these forms, best practices for completion, and resources available to those experiencing financial difficulties.

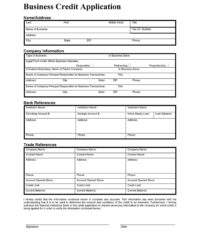

Key Components of a Financial Assistance Request Form

Effective forms for requesting financial assistance are built upon a foundation of essential elements designed to capture a complete and accurate picture of an individual’s financial situation. These components ensure consistent and objective evaluation of each request.

1. Personal Information: This section typically gathers identifying details such as full name, address, contact information, and social security number to ensure accurate record-keeping and verification.

2. Income Details: Documentation of all sources of income, including employment wages, government benefits, and any other recurring income, is crucial for assessing the applicant’s current financial standing.

3. Expense Breakdown: A comprehensive list of monthly expenses, including housing, utilities, food, transportation, and medical costs, provides insight into the applicant’s financial obligations.

4. Asset Declaration: Applicants are typically required to disclose assets like property, vehicles, and savings accounts. This information helps determine the overall financial picture.

5. Debt Obligations: A detailed account of outstanding debts, including loans, credit card balances, and medical bills, contributes to a complete understanding of the applicant’s financial burdens.

6. Hardship Explanation: A narrative explaining the circumstances leading to the financial hardship is crucial. This explanation should include the cause, duration, and impact of the hardship on the applicant’s finances.

7. Supporting Documentation: Relevant supporting documents, such as pay stubs, bank statements, medical bills, and termination letters, substantiate the information provided and contribute to a thorough evaluation of the request.

Accurate and detailed completion of each section ensures fair and efficient processing of financial assistance requests, facilitating a timely response to those in need.

How to Create a Financial Hardship Application Template

Developing a standardized form for financial hardship applications requires careful consideration of various factors to ensure clarity, comprehensiveness, and equitable evaluation. The following steps outline a structured approach to creating such a template.

1. Define the Scope: Clearly define the specific types of hardship the application will address. This focus ensures the template captures relevant information and streamlines the review process.

2. Gather Essential Information Fields: Include fields for personal identification, income details, expense breakdowns, asset declarations, debt obligations, and a narrative explanation of the hardship. Each field should be clearly labeled and provide adequate space for detailed responses.

3. Structure for Clarity and Ease of Use: Organize the template logically, grouping related information together. Use clear headings and subheadings to guide applicants through the process and ensure all necessary information is provided.

4. Ensure Accessibility: Consider diverse needs and provide options for accessible formats, such as large print or alternative languages, to ensure inclusivity.

5. Incorporate Instructions and Guidance: Provide clear and concise instructions for completing each section of the application. Include examples and explanations to minimize ambiguity and ensure accurate information gathering.

6. Specify Required Documentation: Clearly list the supporting documents required to substantiate the information provided in the application. This ensures consistent evaluation and efficient processing.

7. Establish a Review Process: Define clear criteria and procedures for reviewing completed applications. This ensures objective assessment and equitable distribution of assistance.

8. Test and Refine: Pilot test the template with a small group to identify any areas for improvement. Gather feedback and revise the template to optimize clarity, efficiency, and user-friendliness.

A well-designed template facilitates efficient processing and objective evaluation of financial hardship requests, enabling timely and appropriate assistance to those in need. Regular review and revision of the template ensure it remains relevant and effective in addressing evolving circumstances.

Standardized forms for requesting financial assistance serve a critical function in providing structured and equitable support to individuals facing economic challenges. These templates ensure consistent data collection, facilitate efficient processing and objective evaluation of applications, and ultimately enable timely delivery of necessary aid. Careful consideration of key components, clear instructions, and accessibility features contributes to a user-friendly and effective process.

Implementing and refining these structured approaches strengthens the ability of organizations and institutions to respond effectively to financial hardship, promoting fairness and transparency in the allocation of resources. Continuous improvement of these processes is essential to meeting the evolving needs of individuals and communities facing economic vulnerability.