Utilizing a pre-designed structure offers several advantages. It simplifies the application process, reduces the likelihood of errors, and ensures consistency in data submission. This streamlined approach can save valuable time and effort for both the applicant and the credit bureau. Furthermore, using a standard form helps maintain compliance with data protection regulations and ensures requests are processed securely.

This discussion will further explore the various types of available formats, legal considerations surrounding access to consumer credit information, and best practices for completing the request process successfully.

Key Components of a Credit Report Application

Accurate and complete information is crucial for successful processing. The following components are typically required:

1. Personal Identifiers: Full legal name (including suffixes), date of birth, and social security number are essential for accurate identification.

2. Current Address: A complete and accurate current residential address, including street number, street name, apartment/unit number (if applicable), city, state, and ZIP code, is required.

3. Previous Addresses: Providing previous addresses for a specified period, typically the past two to five years, assists in verifying identity and credit history.

4. Employment History: Current and previous employment information, including employer names and addresses, may be requested for further verification.

5. Contact Information: A valid phone number and email address allow the credit bureau to contact the applicant if necessary.

6. Reason for Request: Specifying the reason for requesting the report may be required in certain situations.

7. Authorization Signature: A signature authorizing the release of the credit report is often required to ensure compliance with legal and regulatory requirements.

Accurate completion of these sections ensures efficient processing and minimizes potential delays or rejections. Providing all requested information strengthens the application and helps facilitate a timely response.

How to Create a Credit Report Application Template

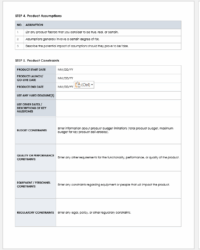

Creating a standardized form for requesting credit reports ensures consistency and efficiency. The following steps outline the process of developing a comprehensive template.

1: Define the Purpose: Clearly establish the specific reason for the credit report request. This clarifies the information required and helps tailor the template accordingly.

2: Gather Required Information Fields: Include fields for essential personal identifiers such as full legal name, date of birth, social security number, and current and previous addresses. Contact information, employment history, and the reason for the request should also be included.

3: Structure the Layout: Organize the template logically, grouping related fields together. Clear labels and instructions improve clarity and ease of use. Ample space for each field should be provided to accommodate all necessary information.

4: Ensure Compliance: Adhere to relevant data protection regulations and industry best practices. Include a clear authorization section for the applicant’s signature, acknowledging consent for the release of their credit information.

5: Choose the Appropriate Format: Select a format compatible with intended usage. Digital formats, such as fillable PDF forms, offer advantages in terms of accessibility and data management. Print versions should be designed for easy legibility and completion.

6: Test and Refine: Pilot test the template with representative users to identify any areas for improvement. Feedback should be used to refine the layout, instructions, and included fields to optimize usability.

A well-designed template facilitates accurate data collection, streamlines the application process, and ensures compliance with relevant regulations. Regular review and updates maintain its effectiveness and relevance within a changing regulatory landscape.

Standardized forms for requesting credit information play a vital role in facilitating efficient and accurate access to consumer credit history. Understanding the key components, benefits, and development process of these structured formats empowers individuals and organizations to navigate the complexities of credit reporting effectively. Adherence to legal requirements and data protection regulations ensures responsible handling of sensitive personal information throughout the process.

Leveraging well-designed templates contributes to a more streamlined and transparent credit reporting ecosystem, ultimately promoting financial well-being and responsible credit management. Continuous refinement and adaptation of these resources are essential to maintain efficacy and compliance within the evolving landscape of consumer credit information management.