Navigating the world of tax regulations can be complex, whether you’re a business owner or an individual seeking expert advice. To ensure clarity, set proper expectations, and streamline the consulting process, a well-defined scope of work is absolutely essential. That’s precisely where a robust tax consulting scope of work template comes into play, serving as your foundational blueprint for successful engagements. It helps articulate what services will be provided, what the client can expect, and perhaps most importantly, what falls outside the agreed-upon tasks.

Imagine embarking on a journey without a map; you might eventually reach your destination, but the path would likely be filled with detours, confusion, and wasted resources. Similarly, engaging in tax consulting without a clear scope can lead to misunderstandings, unmet expectations, and friction between the consultant and the client. A template minimizes these risks by providing a structured framework that both parties can refer to throughout the engagement.

This article will delve into the critical elements that make up an effective tax consulting scope of work, explore how to customize it for various client needs, and ultimately help you understand why having such a template isn’t just a good idea, but a vital component of professional and efficient tax advisory services.

Deconstructing the Core Components of a Tax Consulting Engagement

Every successful tax consulting project begins with a clear understanding of its boundaries and objectives. A comprehensive scope of work document acts as the contract of understanding, ensuring that both the consultant and the client are on the same page from the very beginning. It outlines the specific services to be rendered, the timeline for these services, and the expected outcomes, creating a transparent working relationship built on mutual clarity. This upfront investment in defining the scope saves countless hours and prevents potential disputes down the line, allowing both parties to focus on achieving the desired tax outcomes.

Client Background and Objectives

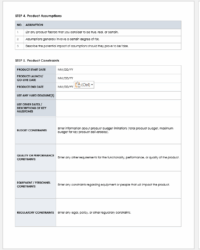

Before any actual tax work begins, it’s crucial to thoroughly understand who the client is and what they aim to achieve. This part of the scope template should detail the client’s name, their business nature (if applicable), their current tax situation, and most importantly, their specific goals for engaging a tax consultant. Are they looking for help with compliance, seeking strategies for tax savings, needing support during an audit, or planning a major transaction? Clearly articulating these objectives ensures that the consulting services provided are precisely tailored to their needs. Gathering this information helps the consultant formulate the most relevant and impactful solutions.

Services to be Provided

This section is the heart of your tax consulting scope of work template. Here, you’ll explicitly list every service that the consultant will perform. Be as specific as possible to avoid ambiguity. Examples include preparing and filing specific tax returns (e.g., corporate, individual, partnership, sales tax), providing tax planning advice, representing the client during a tax audit, conducting tax research on specific issues, or offering guidance on international tax matters. Each service should be clearly defined, perhaps with a brief description of what it entails.

For instance, if “tax planning” is listed, specify whether it includes year-end tax planning, capital gains planning, or estate tax planning. If “audit support” is provided, clarify whether it covers initial document preparation, attendance at IRS meetings, or merely advising on responses to agency inquiries. The more detail you provide here, the less room there is for misinterpretation about what work will be done.

Deliverables and Timelines

Clients want to know what they’re going to get and when. This part of the scope document should outline the tangible outputs or results the client can expect, along with a schedule for their completion. Deliverables might include prepared tax returns, written tax advice memos, financial projections incorporating tax strategies, audit response letters, or even training sessions for the client’s internal staff. Clearly stated deadlines or milestone dates for these deliverables are equally important, providing a roadmap for the engagement and allowing the client to anticipate progress.

Exclusions and Limitations

Just as important as defining what is included is explicitly stating what is not. This section manages client expectations by clearly outlining any services that are outside the scope of the engagement. For example, if the tax consultant is solely focused on income tax, they might state that sales tax compliance or payroll services are excluded. It’s also wise to include limitations, such as the consultant’s reliance on information provided by the client, and that the consultant is not responsible for the accuracy of client-provided data. This upfront honesty is crucial for maintaining a healthy client relationship and protecting the consultant from unreasonable demands or responsibilities.

Tailoring Your Template for Specific Tax Needs

While a general tax consulting scope of work template provides an excellent starting point, the true power of such a document lies in its adaptability. No two clients are exactly alike, and neither are their tax situations. What works for a small business seeking annual compliance might not be suitable for a multinational corporation grappling with complex international tax treaties or an individual planning their estate. Therefore, understanding how to customize your template for various scenarios is absolutely key to delivering exceptional and relevant service.

Customization involves more than just changing a name or date; it requires a deep understanding of the client’s specific industry, their unique financial structure, and their long-term objectives. For instance, a consultant working with a tech startup might need to include specific provisions for R&D tax credits, stock options, or venture capital funding implications, whereas a consultant advising a real estate developer would focus on property taxes, depreciation strategies, and capital gains from asset sales. This tailored approach ensures that the scope accurately reflects the specialized expertise being offered and addresses the client’s most pressing concerns.

When customizing, consider these areas where modifications are frequently necessary:

- Industry-specific regulations and compliance requirements (e.g., healthcare, manufacturing, e-commerce).

- International tax considerations for clients with global operations or foreign income.

- Specific project types, such as mergers and acquisitions, business valuations, or restructuring advice.

- Personal versus business tax planning, where individual wealth management strategies might intertwine with corporate tax efficiency.

- Specific audit defense scenarios, ranging from state sales tax audits to complex federal income tax examinations.

Regularly reviewing and updating your base template with lessons learned from previous engagements and changes in tax law will also ensure its continued relevance and effectiveness.

Developing and utilizing a detailed scope of work is more than just administrative paperwork; it’s a strategic move that underpins the success of every tax consulting engagement. It fosters clear communication, sets realistic expectations, and provides a professional framework for delivering valuable tax advice.

By meticulously defining the services, deliverables, and boundaries, tax professionals can focus on providing top-tier guidance while clients gain peace of mind knowing exactly what to expect. This collaborative clarity ultimately leads to stronger relationships, more efficient processes, and optimal financial outcomes for all parties involved.