Standardized digital forms offer advantages over traditional paper-based methods, including increased efficiency through automated data entry, reduced processing time, improved accuracy through built-in validation, and enhanced accessibility for applicants. These forms can also facilitate secure storage and retrieval of sensitive data, contributing to better record keeping and compliance.

This structured approach to credit applications supports more efficient assessment, enabling lenders to make informed decisions promptly. The subsequent sections will explore the key components of these forms and offer practical guidance for both creating and completing them effectively.

Key Components of a Credit Application Form

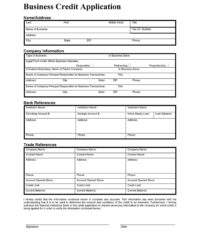

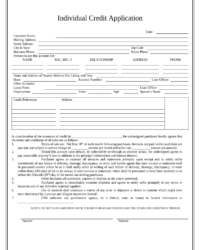

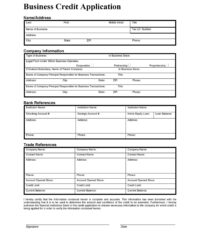

Effective credit applications require specific data points to facilitate thorough assessments. The following components are typically included:

1. Personal Information: This section collects fundamental identifiers such as full legal name, date of birth, social security number, and current contact information. Accurate personal data is crucial for verifying identity and conducting background checks.

2. Employment History: Details regarding current and previous employment, including employer names, dates of employment, and income earned, are essential for evaluating financial stability and repayment capacity.

3. Financial Information: Applicants typically disclose assets, liabilities, and other financial obligations to provide a comprehensive overview of their financial standing. This includes details about bank accounts, investments, outstanding loans, and monthly expenses.

4. Credit History: Existing credit accounts, including credit card details and loan information, are crucial for assessing creditworthiness. This section may request account numbers, credit limits, and outstanding balances.

5. References: Contact information for personal or professional references can provide additional insights into an applicant’s character and reliability.

6. Authorization and Consent: This section typically includes a signature line and a statement authorizing the lender to access credit reports and verify the information provided. Applicants acknowledge the terms and conditions of the application process.

The comprehensive collection of this data enables informed lending decisions, benefiting both the applicant and the lending institution.

How to Create a Fillable Credit Application Template

Developing a robust and effective credit application template requires careful consideration of various factors, ensuring compliance, and promoting efficient data collection. The following steps outline the process:

1: Define Objectives and Scope: Determine the specific information required based on the type of credit product offered. Consider legal and regulatory requirements relevant to the lending industry.

2: Select an Appropriate Format: Choose a digital format conducive to online completion and electronic submission, such as a PDF form. Ensure compatibility with various devices and operating systems.

3: Structure and Organize Information: Group related fields logically to facilitate a clear and intuitive user experience. Use headings and subheadings to guide applicants through the form.

4: Incorporate Required Fields: Include all essential data points, such as personal information, employment history, financial details, credit history, and references. Clearly label each field and indicate mandatory fields.

5: Implement Input Validation: Integrate data validation features to minimize errors and ensure data integrity. Restrict input types for specific fields (e.g., numbers for phone numbers) and implement format validation.

6: Design for Accessibility: Adhere to accessibility guidelines to ensure usability for all applicants. Use clear fonts, appropriate font sizes, and sufficient color contrast. Provide alternative text for images and other non-text elements.

7: Integrate Security Measures: Implement security measures to protect sensitive data. Utilize encryption and secure storage solutions to safeguard applicant information.

8: Test and Refine: Thoroughly test the form to identify and resolve any usability issues or technical glitches. Gather feedback and refine the template as needed to optimize the application process.

A well-designed template ensures a consistent and streamlined application process, contributing to efficient data collection, improved accuracy, and enhanced applicant experience. Careful planning and execution are crucial for creating a template that meets both business needs and regulatory requirements.

Standardized digital credit application forms offer significant advantages in streamlining lending processes, improving data accuracy, and enhancing the overall experience for both applicants and lenders. From the detailed collection of personal and financial information to the implementation of robust security measures, a well-designed template ensures efficient data processing and informed decision-making. Key components, such as comprehensive personal data fields, employment and financial history sections, and credit history inquiries, contribute to a thorough evaluation of creditworthiness.

Effective implementation of these digital tools empowers lending institutions to navigate the complexities of credit assessments with increased efficiency and accuracy. As technology continues to evolve, the ongoing refinement and adaptation of these templates will remain crucial for maintaining best practices within the lending industry, fostering responsible lending, and driving financial progress.