Utilizing a readily available document in this format offers several advantages. It streamlines the application process for potential borrowers, providing a clear and easily understandable format. Furthermore, it allows businesses to maintain organized records and efficiently process applications. The readily accessible nature of such documents eliminates the need for complex software or online portals, broadening accessibility for all parties.

This discussion will further examine the practical uses, legal considerations, and best practices associated with these valuable resources for businesses and individuals seeking credit.

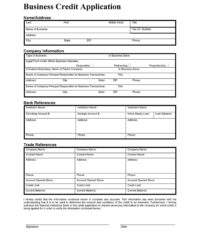

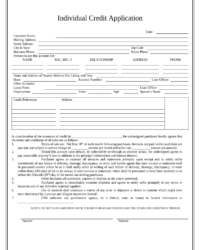

Key Components of a Credit Application Form

Effective credit applications require specific data points to facilitate informed lending decisions. These components ensure consistent data collection and enable thorough applicant assessment.

1: Personal Information: This section typically includes full legal name, current address, contact information, date of birth, and social security number. Accurate personal details are essential for identity verification and credit reporting.

2: Employment History: Details regarding current and previous employers, including dates of employment, job titles, and income, provide insight into an applicant’s financial stability and earning potential.

3: Financial Information: Applicants are generally asked to disclose existing debts, including loans, credit cards, and mortgages. Information on assets, such as real estate or investments, may also be required. This data allows lenders to assess debt-to-income ratio and overall financial health.

4: Credit References: Listing existing credit accounts, including account numbers and creditor contact information, permits verification of credit history and repayment patterns.

5: Loan Request Details: The specific purpose and amount of the requested credit should be clearly stated. This helps lenders understand the applicant’s needs and tailor suitable credit products.

6: Authorization and Declarations: A signature line, coupled with declarations affirming the accuracy of the provided information and authorizing credit checks, are vital for legal compliance and transparency.

A comprehensive application form facilitates consistent data collection, enabling a thorough credit risk assessment. This standardized approach promotes fair lending practices and aids in responsible financial decision-making.

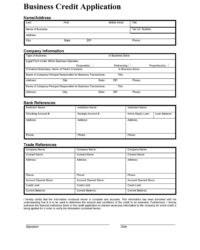

How to Create a Printable Credit Application Template

Developing a robust credit application template requires careful consideration of essential components and legal compliance. A well-structured template ensures efficient data collection and facilitates informed lending decisions.

1: Define the Purpose: Clearly establish the specific type of credit the application will be used for (e.g., personal loan, business loan, credit card). This dictates the information required.

2: Gather Essential Data Points: Include sections for personal information, employment history, financial details, credit references, loan request details, and authorization declarations. Ensure all fields necessary for a comprehensive credit assessment are incorporated.

3: Structure the Layout: Organize the information logically and clearly, using headings and subheadings for easy navigation. A clean, uncluttered design enhances readability and usability.

4: Ensure Legal Compliance: Adhere to relevant regulations, including data privacy laws and fair lending practices. Include necessary disclaimers and disclosures.

5: Choose an Accessible Format: Utilize a widely accessible file format, such as PDF or DOCX, to ensure compatibility across various platforms and devices. The format should allow for easy printing and digital completion.

6: Test and Refine: Thoroughly review the template for clarity, completeness, and accuracy. Conduct pilot testing to identify and address any potential usability issues.

A meticulously crafted template streamlines the application process, ensures data consistency, and supports responsible lending practices. Adherence to these guidelines yields a professional and effective tool for creditworthiness evaluation.

Access to well-designed, readily available application forms provides a crucial foundation for responsible lending and borrowing practices. Standardized data collection through such forms enables consistent evaluation, facilitates informed decision-making, and promotes transparency throughout the credit application process. Understanding the key components, legal considerations, and best practices for creation and utilization of these documents benefits both lenders and applicants.

Effective credit management relies on accurate information and streamlined procedures. Leveraging professionally designed resources contributes significantly to a more efficient and equitable credit landscape, fostering financial stability and responsible growth.