Utilizing a pre-designed structure offers several advantages. It helps borrowers organize necessary information, reducing the likelihood of omissions. This organized approach can also expedite the application review, potentially leading to faster loan processing times. Furthermore, standardized forms promote transparency by clearly outlining required information.

Understanding the components and purpose of these structured forms is crucial for anyone considering borrowing funds. The following sections will explore the key elements typically included in such a form, providing further guidance on completing the application process effectively.

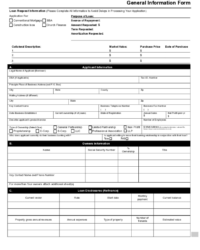

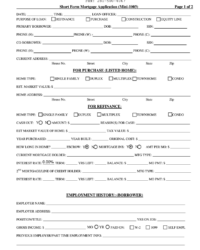

Key Components of a Standard Borrowing Form

Several essential elements comprise a typical borrowing form. These components provide lenders with the necessary information to assess creditworthiness and make informed lending decisions.

1. Personal Information: This section typically requests full legal name, current address, contact information, date of birth, and social security number. Accurate and complete information is crucial for verification purposes.

2. Employment Details: Information about current employment status, employer name, length of employment, and income details are typically required. This data helps assess income stability and repayment capacity.

3. Loan Details: The desired loan amount and intended loan purpose are key components. Lenders may require supporting documentation based on the stated purpose.

4. Financial Information: Existing debts, assets, and other financial obligations are often disclosed in this section. This provides a comprehensive overview of the applicant’s financial standing.

5. Credit Authorization: Applicants typically grant permission for lenders to access their credit reports. This allows lenders to review credit history and assess creditworthiness.

Accurate and complete information across all sections is essential for efficient processing. Each element plays a vital role in the lender’s evaluation process, contributing to a well-informed lending decision.

How to Create a Standardized Borrowing Form

Developing a standardized borrowing form requires careful consideration of various factors. A well-designed form ensures efficient data collection and facilitates streamlined processing.

1. Define the Purpose: Clearly outline the specific purpose of the form. Consider the type of loan, target audience, and required information.

2. Gather Essential Elements: Include sections for personal information, employment details, loan specifics, financial information, and credit authorization. Each section should collect relevant data for comprehensive applicant assessment.

3. Structure the Form Logically: Organize sections in a logical sequence for ease of completion. Clear headings and concise instructions enhance user experience.

4. Ensure Clarity and Conciseness: Use clear and concise language throughout the form. Avoid jargon and complex terminology. Provide brief explanations where necessary.

5. Incorporate Disclosures and Consent: Include necessary disclosures and consent statements related to data privacy and credit checks. Ensure compliance with applicable regulations.

6. Test and Refine: Thoroughly test the form with representative users to identify any potential areas for improvement. Refine the form based on feedback and testing results.

7. Maintain Accessibility: Design the form to be accessible to individuals with disabilities. Consider font sizes, color contrast, and screen reader compatibility.

8. Regularly Review and Update: Periodically review and update the form to ensure accuracy and compliance with evolving regulations and lending practices.

A well-structured form provides a consistent framework for collecting applicant data. It streamlines the application process, enhances transparency, and aids in informed decision-making.

Standardized borrowing forms serve as crucial instruments in the lending process, facilitating efficient and transparent interactions between borrowers and lenders. These structured documents ensure consistent data collection, enabling lenders to effectively assess creditworthiness and make informed decisions. Key elements such as personal information, employment details, loan specifics, financial standing, and credit authorization provide a comprehensive overview of the applicant’s profile. Careful design and implementation of these forms contribute to streamlined processing, reduced errors, and enhanced user experience.

Leveraging well-designed forms promotes responsible lending practices by ensuring thorough evaluation and informed decision-making. A consistent approach to data collection contributes to greater transparency and fairness within the financial ecosystem. As financial landscapes evolve, the strategic utilization of standardized forms remains essential for effective and ethical lending processes.