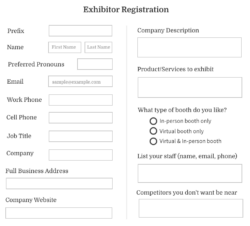

Utilizing such a structure offers several advantages. It saves time and effort by providing a clear roadmap for applicants. It also promotes professionalism by ensuring all necessary information is presented in an organized manner, increasing the likelihood of a successful application. Furthermore, it helps organizers efficiently evaluate submissions and allocate booth space effectively.

trade

Trade Account Application Template

Utilizing a pre-designed structure streamlines the application process for both the applicant and the supplying business. It reduces errors and omissions by clearly outlining required information, leading to faster approval times. This efficiency translates to quicker onboarding of new clients and improved business relationships. Furthermore, it allows businesses to maintain organized records and easily track applications, promoting better internal management.

Business Trade Account Application Template

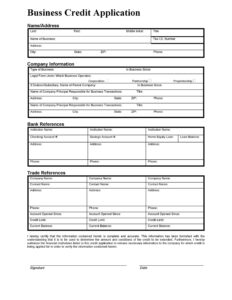

Utilizing such a form offers numerous advantages. It ensures consistent data collection, reducing errors and processing time. This standardization facilitates efficient credit evaluations, ultimately benefiting both the vendor and the applicant. Furthermore, it establishes a clear and transparent process, building trust and promoting positive business relationships.

Trade Credit Application Template

Utilizing such a form offers several advantages. It simplifies the application process for potential buyers, saving them time and effort. For suppliers, it provides a standardized framework for evaluating credit risk, leading to more informed decisions. Furthermore, it promotes transparency and professionalism in the buyer-supplier relationship.