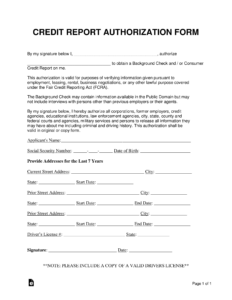

A standardized form facilitates the process of requesting one’s consumer credit history from a credit bureau. This structured format ensures all necessary information is provided accurately and efficiently, minimizing potential delays or rejections. It typically includes fields for personal identifiers, such as full name, date of birth, social security number, and current address. Additional information like previous addresses, employment history, and contact details might also be required depending on the specific reporting agency and the reason for the request.

Utilizing a pre-designed structure offers several advantages. It simplifies the application process, reduces the likelihood of errors, and ensures consistency in data submission. This streamlined approach can save valuable time and effort for both the applicant and the credit bureau. Furthermore, using a standard form helps maintain compliance with data protection regulations and ensures requests are processed securely.

Read more