Utilizing such a structure offers several advantages. It reduces the likelihood of missing crucial data, thereby minimizing back-and-forth communication and expediting the approval process. A standardized format also allows for easier comparison of applications, enabling lenders to make informed decisions quickly and objectively. For applicants, it provides clarity on the required information, simplifying the task of completing the application accurately and thoroughly.

loan

Staff Loan Application Template

Utilizing a pre-designed format offers several advantages. It simplifies the process for employees, reduces processing time for employers, and ensures all necessary information is collected. This minimizes the potential for errors or omissions, leading to more efficient loan processing and decision-making. Furthermore, a consistent structure allows for easier tracking and analysis of loan data, supporting better financial management within the organization.

Small Loan Application Template

Utilizing such a framework offers several advantages. It saves time and effort by eliminating the need to create a request from scratch. The standardized format reduces the likelihood of errors or omissions, leading to faster processing times. Moreover, it provides a professional and organized presentation, enhancing the borrower’s credibility. A well-crafted framework also benefits lenders by ensuring they receive all necessary information upfront, simplifying their review process.

Quick Loan Application Template

Utilizing such a document can save significant time and effort, eliminating the need to create a request from scratch. It also helps ensure accuracy by prompting the inclusion of all essential details. This can lead to quicker processing times and improve the likelihood of approval. Furthermore, it can contribute to a more transparent and professional interaction between the involved parties.

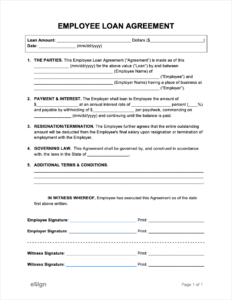

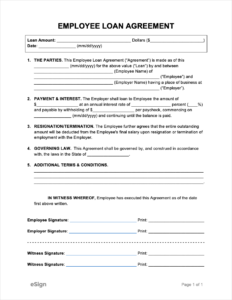

Employee Loan Application Template

Using a pre-designed form provides clarity and transparency for both the employee and the organization. It ensures all necessary details are captured, reducing back-and-forth communication and processing time. This organized approach minimizes confusion and promotes equitable loan assessments. It also allows for efficient tracking and record-keeping of loan applications.

Construction Loan Application Template

Utilizing such a form offers several advantages. It helps borrowers present their projects professionally and thoroughly, increasing the likelihood of approval. The organized structure reduces the risk of omitting crucial details, saving time and effort for both borrowers and lenders. Furthermore, it promotes transparency and clarity in the loan application process, fostering a stronger understanding between the parties involved.

Construction Bank Loan Application Template

Using a pre-designed format offers several advantages. It streamlines the application process, saving time and effort for both borrowers and lenders. Clear guidelines within the form help ensure completeness, reducing the likelihood of rejected applications due to missing information. Furthermore, a standardized approach promotes transparency and clarity in loan terms and requirements.

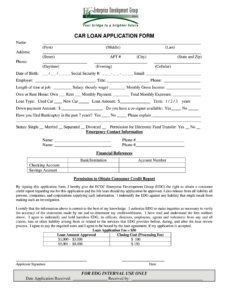

Car Loan Credit Application Template

Utilizing a pre-designed structure offers several advantages. It ensures all necessary information is collected, reducing the likelihood of delays due to incomplete applications. This standardized format also allows for easier comparison of applicant profiles, enabling lenders to make informed decisions quickly. Furthermore, it can help applicants present their information clearly and concisely, potentially improving their chances of approval.

Blank Loan Application Template

Utilizing such a document offers several advantages. It helps ensure all required information is provided, reducing the likelihood of delays or rejections due to incomplete applications. Furthermore, the standardized structure simplifies the comparison of offers from different lenders. Borrowers also benefit from a clear understanding of the information needed before engaging with a lender, allowing for better preparation and a smoother application process.

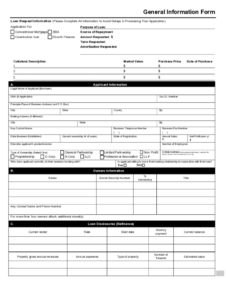

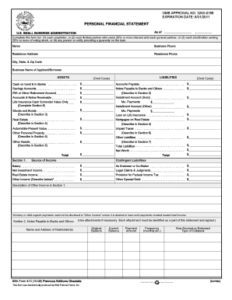

Small Business Loan Application Template

Utilizing such a framework offers several advantages. It saves time and effort by providing a clear structure, reducing the likelihood of omitting crucial details. A well-organized application also presents a professional image to potential lenders, increasing the chances of a favorable review. Furthermore, it helps entrepreneurs thoroughly assess their financial needs and prepare a robust funding request.