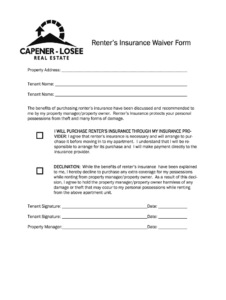

Utilizing a structured form offers several advantages. It simplifies the process of applying for necessary coverage, ensuring all essential details are captured. This structured approach reduces the likelihood of errors or omissions, leading to a smoother and more efficient application experience. Additionally, it allows applicants to compare quotes from different providers more easily due to the consistent information requested.

insurance

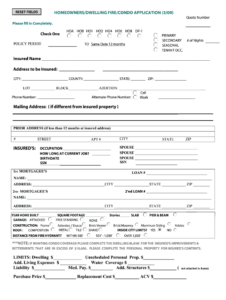

Homeowners Insurance Application Template

Utilizing a standardized form offers several advantages. It simplifies the process, reducing the likelihood of errors or omissions. This clarity benefits applicants by ensuring they provide all necessary information, and it aids insurers in accurately assessing risk and determining appropriate coverage. A standardized approach also facilitates faster processing and reduces ambiguity, leading to a more efficient experience for all parties involved.

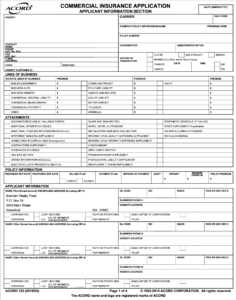

Commercial Insurance Application Template

Utilizing such a form offers several advantages. It streamlines the application process, reducing time and effort for both the applicant and the insurer. The standardized format minimizes the risk of omissions or errors, leading to more accurate and complete submissions. This, in turn, can expedite the underwriting process and potentially contribute to more favorable policy terms. Furthermore, a well-designed form can enhance clarity and transparency, ensuring all necessary information is provided and understood by both parties.

Auto Insurance Application Template

Utilizing a pre-designed structure offers several advantages. It simplifies the process for applicants, ensuring all essential information is provided. This reduces the likelihood of incomplete applications and speeds up processing time. For insurance providers, these forms facilitate efficient data analysis and comparison, contributing to accurate risk assessment and streamlined underwriting procedures. This standardization ultimately benefits both applicants and insurers.