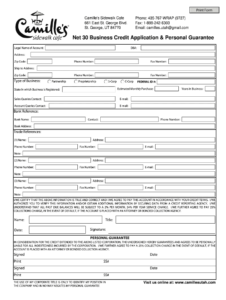

Securing financing for a company often involves completing standardized forms requesting detailed information about the business’s operations, financial history, and future projections. When such financing requires the owner to accept personal liability for the debt, an additional assurance is added to the process. This commitment ensures lenders have recourse against the owner’s personal assets if the business defaults on its obligations. Having a pre-designed structure for this process streamlines the application procedure for both the borrower and the lender.

A standardized structure offers several advantages. It ensures all necessary information is gathered consistently, reducing processing time and potential errors. For borrowers, it clarifies the lender’s requirements, simplifying the application process and potentially improving the chances of approval. For lenders, it provides a consistent framework for risk assessment, facilitating more efficient and informed lending decisions. The added layer of personal commitment can also increase access to credit and potentially more favorable terms.

Read more