Utilizing such a structure can significantly enhance the application process. It helps individuals present their qualifications clearly and concisely, increasing the likelihood of making a positive impression. For organizations, these standardized documents save time and resources by simplifying candidate screening. Furthermore, they promote fairness and objectivity by providing a uniform evaluation framework.

customer

Customer Account Application Template

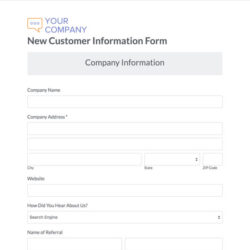

Utilizing a pre-designed structure streamlines the signup process, saving valuable time for both the client and the organization. This improved efficiency reduces administrative overhead and allows for quicker processing of applications. Furthermore, standardized data collection improves data accuracy and completeness, leading to better informed business decisions and enhanced customer relationship management. A professional and well-designed format also contributes to a positive first impression, enhancing the organization’s brand image.

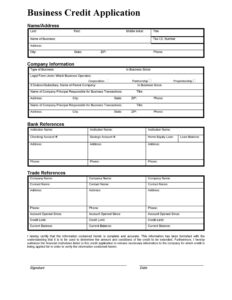

Credit Application Template For Customer

Utilizing such forms streamlines the application process for both the applicant and the business. Standardization reduces errors and omissions, leading to quicker processing times. A well-designed form also ensures compliance with relevant regulations and promotes fairness by applying consistent criteria to all applicants. This ultimately contributes to a more robust and transparent credit assessment process.

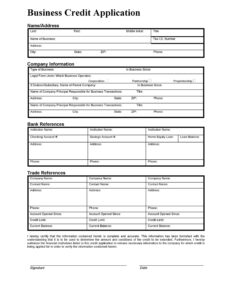

Business Customer Application Template

Utilizing a pre-designed structure offers several advantages. It simplifies the process for applicants, reduces the administrative burden on the organization, and allows for quicker processing and decision-making. This improved efficiency can lead to increased customer satisfaction and faster business growth. Standardized data collection also facilitates better reporting and analysis, providing valuable insights into customer demographics and needs.

New Customer Application Template

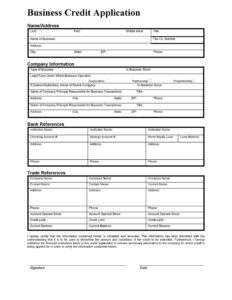

Customer Credit Application Template

Utilizing such a standardized form offers numerous advantages, including streamlined data collection, improved accuracy, reduced processing time, and consistent evaluation criteria across all applicants. This consistency promotes fair lending practices and allows businesses to manage credit risk more effectively.