Standardized forms streamline the financing process, enabling quicker loan approvals and enhanced customer experience. Consistent data collection improves accuracy and reduces processing errors, benefiting both the dealership and the purchaser. Furthermore, these documents ensure compliance with lending regulations and provide transparency regarding the information required for credit evaluations. A clear, concise, and user-friendly form fosters trust and facilitates open communication between the dealership and potential buyers.

credit

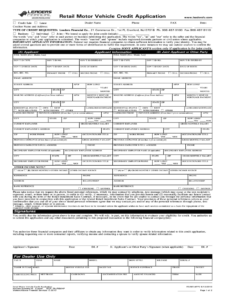

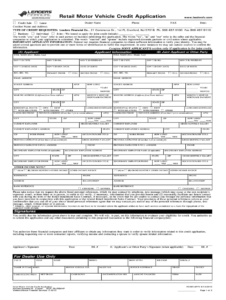

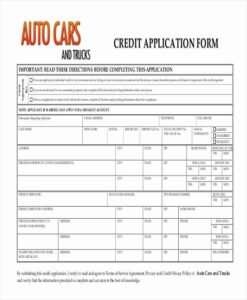

Car Dealer Credit Application Template

Utilizing such a standardized form streamlines the financing process, ensuring consistent data collection and expediting loan approvals. This benefits both the dealership and the customer by reducing paperwork, minimizing errors, and promoting transparency in the transaction. Furthermore, a standardized approach allows for efficient comparisons of loan offers from different lenders.

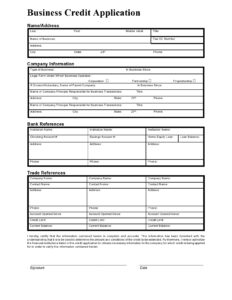

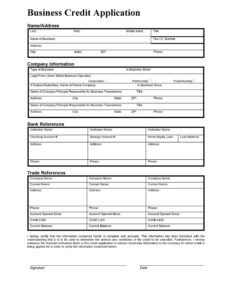

Business Vendor Credit Application Template

Utilizing a structured form for credit evaluation offers numerous advantages. It ensures consistency in data collection, facilitates efficient processing of applications, and reduces the likelihood of errors. Furthermore, it helps establish clear expectations and terms for both the supplier and the customer, promoting a transparent and professional business relationship. Ultimately, a robust credit evaluation process contributes to healthy cash flow management and minimizes the risk of bad debt.

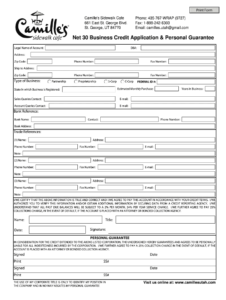

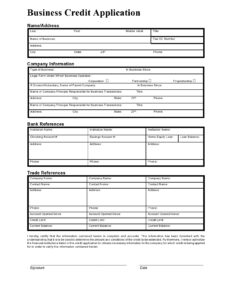

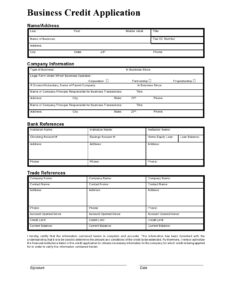

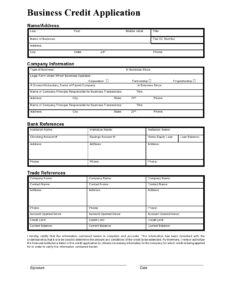

Business Credit Application Template With Personal Guarantee

A standardized structure offers several advantages. It ensures all necessary information is gathered consistently, reducing processing time and potential errors. For borrowers, it clarifies the lender’s requirements, simplifying the application process and potentially improving the chances of approval. For lenders, it provides a consistent framework for risk assessment, facilitating more efficient and informed lending decisions. The added layer of personal commitment can also increase access to credit and potentially more favorable terms.

Business Credit Application Template Uk

Utilizing a pre-designed structure offers several advantages. It saves time and effort for applicants by providing a clear framework for presenting necessary details. Furthermore, it ensures that all essential information is included, reducing the likelihood of delays caused by incomplete applications. For lenders, these standardized forms facilitate efficient processing and comparison of applications, contributing to faster decision-making.

Business Credit Application Template Canada

Utilizing a pre-designed structure offers several advantages. It saves time and effort by providing a clear framework for information gathering. This organized approach reduces the likelihood of omissions and ensures all essential details are included, thereby increasing the chances of application success. Furthermore, a consistent format allows businesses to present themselves professionally and demonstrate preparedness to potential lenders.

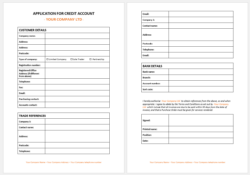

Business Credit Account Application Template

Utilizing a pre-designed structure offers several advantages. It saves time and effort by providing a clear framework for compiling required data. This organized approach also increases the likelihood of a complete and accurate submission, which can improve the chances of approval. Furthermore, it helps businesses present a professional image to potential lenders.

Business Account Credit Application Template

Utilizing such a form offers numerous advantages. It simplifies the application process for businesses, saving time and reducing errors. For lenders, it facilitates consistent evaluation, allowing for objective comparison and quicker processing. This standardization contributes to better risk management and informed lending decisions. Furthermore, a well-designed form promotes transparency, ensuring both parties understand the terms and requirements involved.

Blank Business Credit Application Template

Utilizing a pre-structured form offers several advantages. It ensures consistency in data collection, facilitating a streamlined and efficient review process for lenders. It also provides businesses with a clear understanding of the information required, reducing the likelihood of omissions or errors that could delay the application process. Furthermore, a readily available format allows businesses to prepare the necessary information in advance, saving valuable time and resources.

Automobile Credit Application Template

Utilizing such a form offers several advantages. It ensures consistency in data collection, simplifies the application process for both borrowers and lenders, and facilitates efficient processing and evaluation of loan applications. This standardized approach reduces the likelihood of errors and omissions, contributing to a smoother and quicker financing experience.