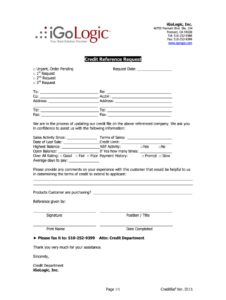

Utilizing such a form offers significant advantages. It reduces the likelihood of overlooking crucial data points, ensuring a thorough evaluation. Furthermore, it promotes efficiency by providing a clear framework for both the applicant and the assessing business. Standardization also aids in compliance with data privacy regulations and ensures fair and objective credit decisions.

credit

Credit Application Template Uk

Utilizing a structured form offers several advantages. It streamlines the application process for both borrowers and lenders, reducing errors and processing time. Standardization ensures all necessary information is gathered, increasing the likelihood of a complete and accurate application. This can lead to quicker decisions and potentially improve the chances of approval.

Credit Application Template Nz

Utilizing a structured form offers several advantages. Applicants benefit from clear guidance on required information, reducing the likelihood of errors or omissions that could delay processing. For lenders, standardized data facilitates streamlined assessment and comparison across applications, enhancing efficiency and fairness. This can lead to faster approval times and potentially better terms for borrowers.

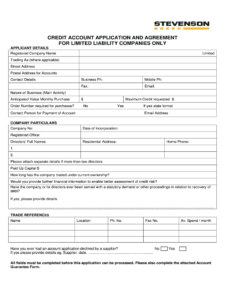

Credit Application Template Australia

Using such forms offers several advantages. A structured approach reduces the likelihood of omissions and errors, leading to faster processing. Borrowers gain a clearer understanding of the required information, promoting transparency and informed decision-making. Lenders benefit from consistent data presentation, simplifying comparisons and expediting approvals.

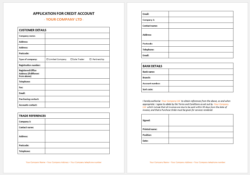

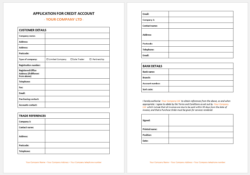

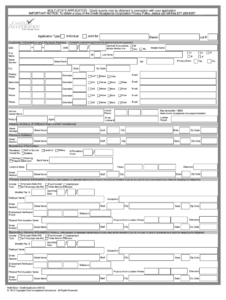

Credit Account Application Template Uk

Utilizing a pre-designed structure offers several advantages. It ensures consistent data collection, simplifies the application process for both the applicant and the lender, and reduces the likelihood of errors or omissions. This streamlined approach can expedite the approval process and contribute to a more efficient lending ecosystem. Furthermore, readily available examples can assist individuals in understanding the information required and presenting it effectively.

Credit Acceptance Credit Application Template

Utilizing a pre-designed structure offers several advantages for both dealerships and applicants. It simplifies the application procedure, reduces the likelihood of errors or omissions, and accelerates the overall financing timeline. Dealerships benefit from improved operational efficiency and faster funding, while applicants experience a more straightforward and transparent application process. This streamlined approach can contribute to increased customer satisfaction and improved access to vehicle financing.

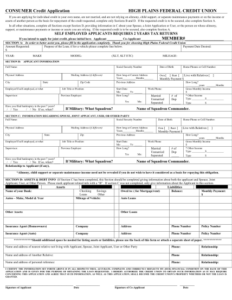

Consumer Joint Credit Application Template

Utilizing a standardized form promotes transparency and clarity for all parties involved. A clear, well-organized application can simplify the process, reduce errors, and expedite the approval process. It ensures both applicants understand their shared financial obligations and the information being provided to the lending institution.

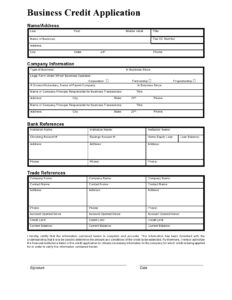

Company Business Credit Application Template

Utilizing a predefined structure offers numerous advantages. It simplifies the application process for businesses, reduces the likelihood of missing critical information, and expedites credit decisions. Furthermore, standardized forms enable efficient comparison and analysis of applications, contributing to fairer and more objective credit assessments. This ultimately fosters stronger vendor-client relationships built on trust and transparency.

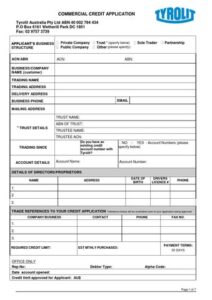

Commercial Credit Application Template Australia

Utilizing a structured form streamlines the application process for both borrowers and lenders. It ensures consistent data collection, facilitates efficient risk assessment, and reduces the likelihood of errors or omissions. This standardization can lead to faster processing times and improve the chances of successful applications. Furthermore, a well-crafted application can present a professional image and instill confidence in potential creditors.

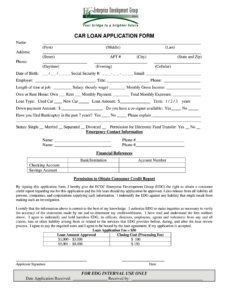

Car Loan Credit Application Template

Utilizing a pre-designed structure offers several advantages. It ensures all necessary information is collected, reducing the likelihood of delays due to incomplete applications. This standardized format also allows for easier comparison of applicant profiles, enabling lenders to make informed decisions quickly. Furthermore, it can help applicants present their information clearly and concisely, potentially improving their chances of approval.