Utilizing a standardized form promotes transparency and clarity for all parties involved. A clear, well-organized application can simplify the process, reduce errors, and expedite the approval process. It ensures both applicants understand their shared financial obligations and the information being provided to the lending institution.

consumer

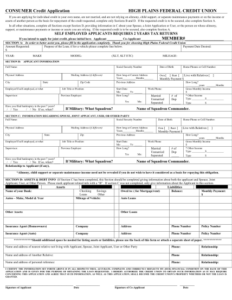

Consumer Loan Application Template

Utilizing a pre-designed structure offers several advantages. It streamlines the borrowing process, saving applicants time and effort. The standardized format ensures all necessary information is provided, reducing the likelihood of delays caused by incomplete applications. Lenders benefit from a consistent data format, which simplifies their review and decision-making processes. This can lead to faster loan approvals and ultimately, a smoother borrowing experience.

Consumer Credit Application Template

Standardized forms promote efficiency and fairness by ensuring all applicants are evaluated based on the same criteria. This organized approach simplifies record-keeping and analysis for lenders. For applicants, pre-defined fields clarify required information, reducing the likelihood of incomplete applications and expediting the approval process.