Utilizing pre-designed formats offers several advantages. Businesses benefit from improved efficiency in processing applications and reduced administrative overhead. Applicants experience a more transparent and user-friendly process, understanding clearly the information required. Consistent data collection also supports more informed credit assessments and facilitates better risk management.

australia

Credit Application Template Australia

Using such forms offers several advantages. A structured approach reduces the likelihood of omissions and errors, leading to faster processing. Borrowers gain a clearer understanding of the required information, promoting transparency and informed decision-making. Lenders benefit from consistent data presentation, simplifying comparisons and expediting approvals.

Credit Account Application Template Australia

Utilizing a pre-designed structure offers several advantages. For applicants, it simplifies the application process, ensuring all required information is provided, thereby reducing the likelihood of rejection due to incomplete submissions. For lenders, it facilitates consistent evaluation and comparison of applications, enabling faster processing and more objective decision-making. Standardization also improves data management and analysis.

Commercial Credit Application Template Australia

Utilizing a structured form streamlines the application process for both borrowers and lenders. It ensures consistent data collection, facilitates efficient risk assessment, and reduces the likelihood of errors or omissions. This standardization can lead to faster processing times and improve the chances of successful applications. Furthermore, a well-crafted application can present a professional image and instill confidence in potential creditors.

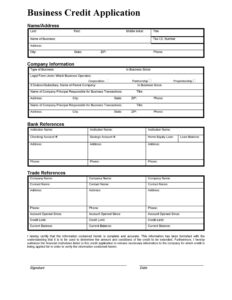

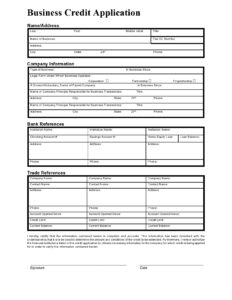

Business Credit Application Template Australia

Utilizing a pre-designed structure offers several advantages. It saves time and effort for both the applicant and the lender, reduces the likelihood of errors or omissions, and promotes transparency. A well-crafted form can also strengthen the borrower’s credibility by presenting a professional and organized image. Ultimately, it increases the efficiency of the credit application process, allowing lenders to assess requests more quickly and effectively.