Utilizing a structured form offers several advantages. It simplifies the process of applying for necessary coverage, ensuring all essential details are captured. This structured approach reduces the likelihood of errors or omissions, leading to a smoother and more efficient application experience. Additionally, it allows applicants to compare quotes from different providers more easily due to the consistent information requested.

This understanding of the purpose and benefits of structured application forms for securing coverage for rented properties provides a foundation for exploring the key elements within these forms, various types available, and best practices for completion.

Key Components of a Renters Insurance Application

Standard application forms for tenant coverage typically require specific information to assess risk and determine appropriate coverage options. Understanding these key components facilitates a smooth and efficient application process.

1: Personal Information: This section collects identifying information such as the applicant’s full name, current address, date of birth, and contact details. Accurate personal information is crucial for policy issuance and communication.

2: Property Information: Details about the rented property, including the address, type of dwelling (apartment, house, etc.), and age of the building, are essential for assessing risk.

3: Coverage Details: Applicants specify the desired coverage amounts for personal property, liability protection, and additional living expenses. Understanding these coverage types is vital for selecting appropriate protection levels.

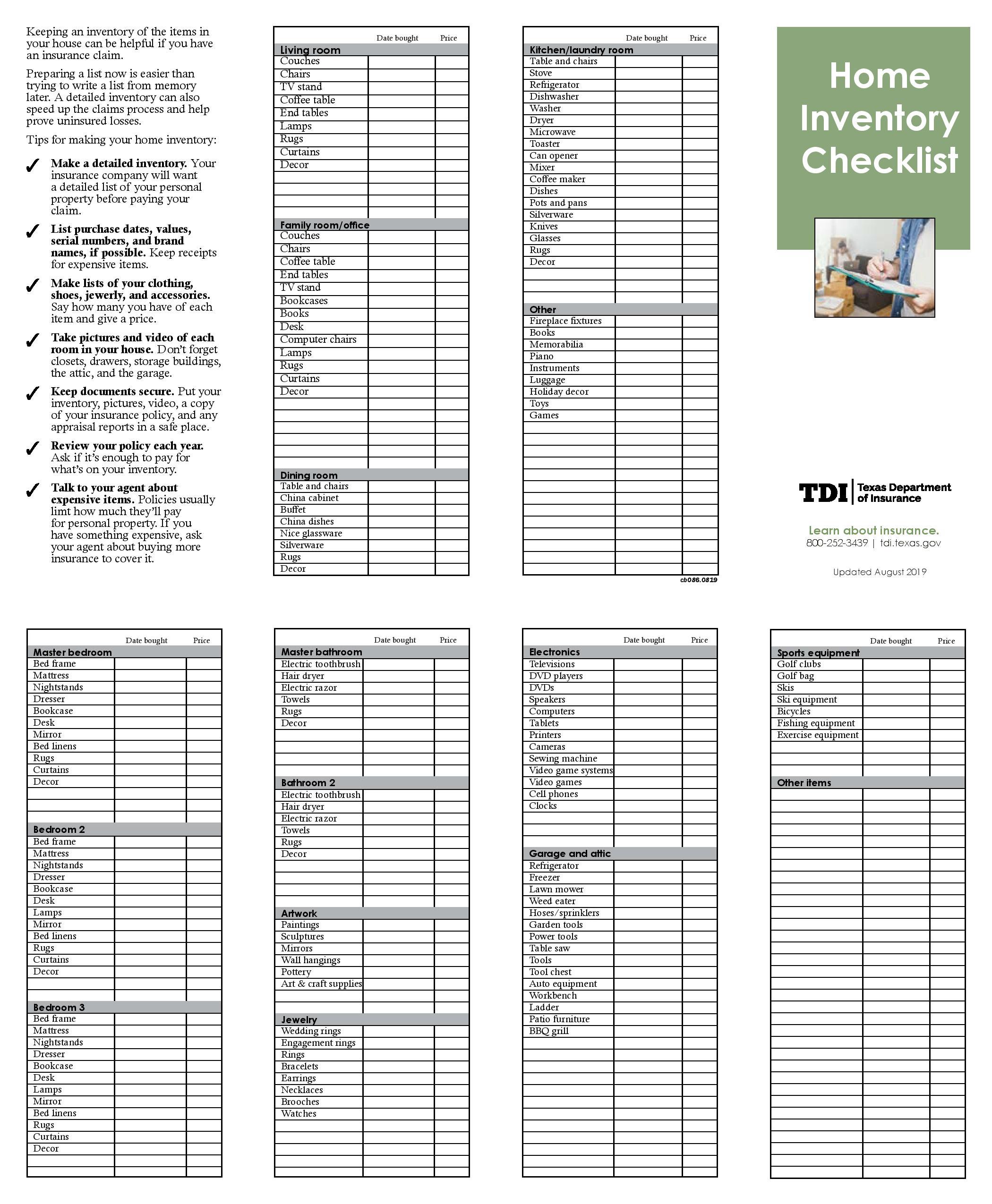

4: Personal Property Value: An estimated value of personal belongings helps determine the necessary coverage amount. Detailed inventories or photographs can support these estimations.

5: Deductible Selection: Applicants choose their preferred deductible amount, impacting both the premium and the out-of-pocket expenses in the event of a claim.

6: Prior Insurance Information: Details about previous insurance policies, including claims history, may be requested. This information helps insurers assess risk and determine eligibility.

Accurate and complete information across these areas ensures appropriate coverage and a streamlined application experience. Careful consideration of each component allows applicants to tailor the policy to individual needs and circumstances.

How to Create a Renters Insurance Application Template

Creating a standardized form for renters insurance involves structuring key data fields to collect necessary applicant and property information. A well-designed template ensures comprehensive data collection and streamlines the application process.

1: Define Purpose and Scope: Clearly outline the specific information required for the application. This includes applicant details, property specifics, coverage options, and declarations.

2: Structure Data Fields: Organize the template into logical sections with clear labels for each data field. Categorization improves readability and ensures all necessary information is captured.

3: Incorporate Instructions and Help Text: Provide concise instructions and explanations for each section. Clear guidance minimizes ambiguity and facilitates accurate completion.

4: Ensure Accessibility and Clarity: Use clear and concise language, avoiding jargon. A straightforward presentation ensures comprehension and encourages accurate data entry.

5: Implement Data Validation: Incorporate data validation rules to ensure data integrity and minimize errors. Validation checks for data type, format, and completeness.

6: Test and Refine: Thoroughly test the template with representative users to identify any usability issues. Feedback gathered informs revisions and improvements.

7: Maintain Version Control: Track revisions and maintain version control to ensure consistency and facilitate updates. Clear versioning simplifies document management.

8: Compliance and Legal Considerations: Adhere to applicable regulations and legal requirements related to data privacy and information collection. Compliance safeguards sensitive information and ensures ethical practices.

A well-designed template facilitates efficient data collection, ensures accuracy, and streamlines the application process for both applicants and insurance providers. Careful consideration of these elements contributes to a robust and user-friendly form.

Standardized forms for renters insurance serve as crucial tools for collecting essential information, facilitating efficient processing, and ensuring appropriate coverage. Understanding the key components, benefits, and creation process of these templates allows for a streamlined application experience. Accurate and complete information provided within these structured formats enables insurance providers to assess risk effectively and offer tailored coverage options to protect tenants’ valuable possessions and personal liability.

Effective utilization of these structured application tools empowers individuals to secure necessary coverage with greater ease and confidence, contributing to a more secure renting experience. The continued development and refinement of these resources remain essential for promoting accessible and comprehensive insurance protection within the rental market.