Using a pre-designed form provides clarity and transparency for both the employee and the organization. It ensures all necessary details are captured, reducing back-and-forth communication and processing time. This organized approach minimizes confusion and promotes equitable loan assessments. It also allows for efficient tracking and record-keeping of loan applications.

This foundation of a well-structured application process allows for a deeper exploration of topics such as legal considerations, ethical implications, and best practices for implementation, fostering a positive and productive borrowing experience within the workplace.

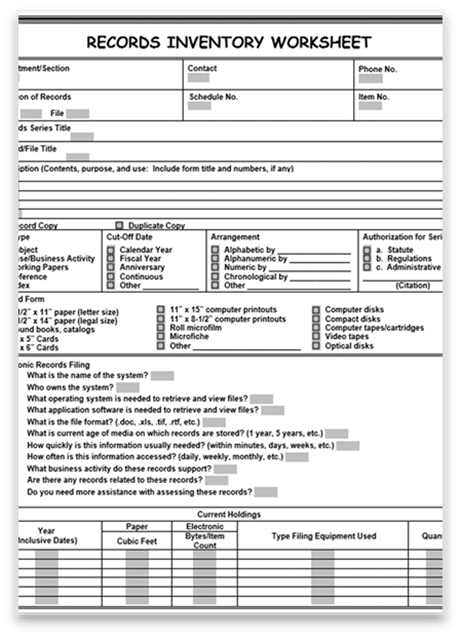

Key Components of an Employee Loan Application

A comprehensive application ensures clarity and efficiency in the loan process. Several essential elements contribute to a well-structured document.

1: Employee Information: Full legal name, employee ID, department, and contact information are fundamental for identification and communication.

2: Loan Details: The requested amount, intended purpose of the loan, and desired repayment period are crucial for assessment.

3: Repayment Plan: Proposed repayment schedule, including frequency and amount of deductions from salary, demonstrates the employee’s commitment and planning.

4: Supporting Documentation: Depending on the loan type and amount, supporting documents such as pay stubs or financial statements may be required.

5: Acknowledgements and Agreements: Clear statements regarding the terms and conditions of the loan, including interest rates (if applicable), and agreement to repayment terms are essential.

6: Employer Section: A designated area for employer review, approval, and processing information, including date of approval and authorized signatures, ensures proper documentation.

These elements ensure a standardized and transparent process, benefiting both the employee seeking financial assistance and the organization managing the loan program.

How to Create an Employee Loan Application Template

Developing a standardized application template ensures consistency and efficiency in managing employee loan requests. A well-structured template benefits both the organization and its employees.

1: Define Loan Program Parameters: Establish clear guidelines regarding eligible loan types, maximum loan amounts, repayment periods, and any applicable interest rates. These parameters form the foundation of the application.

2: Design the Application Form: Create a user-friendly form that captures essential employee information (name, ID, department), loan details (amount, purpose, repayment period), and supporting documentation requirements.

3: Incorporate Repayment Schedule Section: Include a dedicated section for outlining the proposed repayment plan, including frequency and amount of deductions from salary.

4: Include Acknowledgements and Agreements: Clearly state the terms and conditions of the loan, including any applicable interest rates and repayment terms. Ensure a section for employee signature acknowledging agreement to these terms.

5: Establish an Employer Review Section: Designate a section for employer review, approval, and processing information. This section should include space for signatures and dates.

6: Seek Legal Counsel: Before finalizing the template, consult with legal counsel to ensure compliance with all applicable regulations and to address potential legal considerations.

7: Test and Refine: Pilot test the template with a small group of employees and gather feedback to identify areas for improvement. Refine the template based on this feedback.

8: Communicate and Implement: Clearly communicate the loan program and application process to all employees. Provide easy access to the template and ensure all involved parties understand the procedures.

A well-designed template simplifies the application process, ensuring transparency and efficiency for all stakeholders. Regular review and updates maintain its effectiveness and compliance with evolving legal and organizational requirements.

Standardized application procedures offer a streamlined approach to internal lending, benefiting both organizations and their staff. A well-defined template ensures clarity, consistency, and efficiency throughout the loan process, from initial request to final repayment. Key elements such as comprehensive employee and loan details, clear repayment schedules, and legally sound agreements contribute to a transparent and equitable system.

Careful consideration of legal and ethical implications, coupled with consistent review and refinement of the template, ensures a robust and sustainable program. This proactive approach fosters financial well-being among employees while minimizing risk and maximizing organizational efficiency. Ultimately, a well-managed employee loan program contributes to a positive and productive work environment.