Utilizing such a form offers several advantages. It helps borrowers present their projects professionally and thoroughly, increasing the likelihood of approval. The organized structure reduces the risk of omitting crucial details, saving time and effort for both borrowers and lenders. Furthermore, it promotes transparency and clarity in the loan application process, fostering a stronger understanding between the parties involved.

This foundation of understanding allows for a smoother transition into the specifics of securing and managing such financing. Topics such as understanding the different loan types, preparing a comprehensive budget, and navigating the approval process will be explored further.

Key Components of a Construction Loan Application

A comprehensive application is crucial for securing construction financing. Several key components ensure lenders receive the necessary information to assess project viability and risk.

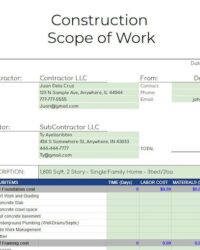

1. Project Information: This section details the project’s scope, including the property address, type of construction (new build, renovation, etc.), and a detailed description of the intended work.

2. Applicant Information: This section requires details about the borrower, including personal and business financial information, credit history, and experience in construction or related fields.

3. Cost Breakdown: A detailed budget outlining all anticipated project costs is essential. This includes material costs, labor expenses, permits, and contingency funds for unforeseen issues.

4. Draw Schedule: This schedule outlines the planned disbursement of funds throughout the project’s lifecycle, tied to specific milestones and completion phases.

5. Loan Terms: The requested loan amount, interest rate, repayment schedule, and any other specific loan terms are outlined here.

6. Supporting Documentation: This may include blueprints, contractor bids, permits, environmental reports, and other documents relevant to the project and the borrower’s qualifications.

7. Appraisal and Inspection Reports: Often, an independent appraisal of the property’s value and inspections during construction are required by lenders.

Providing complete and accurate information in each of these areas significantly increases the likelihood of loan approval and facilitates a smoother financing process. A well-prepared application demonstrates professionalism and preparedness, building trust with lenders and paving the way for a successful project.

How to Create a Construction Loan Application

Developing a robust application requires careful planning and attention to detail. A well-structured application facilitates efficient processing and increases the probability of loan approval.

1: Gather Required Information: Compile all necessary documentation, including financial statements, project plans, cost estimates, and contractor bids. This preliminary step ensures a smooth and efficient application process.

2: Utilize a Template or Software: Employing a pre-designed template or specialized software can streamline the process and ensure all essential information is included. Many financial institutions offer templates, or software solutions can be utilized.

3: Complete Project Details: Provide a comprehensive description of the project, including the scope of work, timelines, and projected completion date. Clear and concise descriptions are essential for lender understanding.

4: Detail the Budget: Include a meticulously detailed budget outlining all anticipated costs, including materials, labor, permits, and contingency funds. Accurate budgeting is crucial for project viability assessment.

5: Outline the Draw Schedule: Specify the planned disbursement of funds throughout the project’s lifecycle, aligning disbursements with project milestones. This demonstrates financial planning and control.

6: Review and Verify: Thoroughly review the completed application for accuracy and completeness before submission. Ensuring data integrity is critical for a successful application.

7: Submit to Lender: Submit the completed application to the chosen lender, adhering to their specific submission guidelines. Prompt and organized submission facilitates timely processing.

Following these steps promotes a well-structured and comprehensive application, enhancing the likelihood of securing the necessary financing. A thorough application demonstrates professionalism and preparedness, instilling confidence in lenders and supporting project success.

Careful preparation and a clear understanding of required components are essential for successful project financing. A standardized form provides a crucial framework for organizing and presenting project details, budget information, and repayment plans, enabling efficient lender review and increasing the likelihood of approval. From project scope and cost breakdowns to draw schedules and supporting documentation, a complete and accurate application demonstrates borrower preparedness and strengthens the lender’s confidence in the project’s viability.

Securing construction financing requires a strategic approach, and the effective use of such a structure plays a vital role in this process. By understanding the key elements and following best practices, borrowers can navigate the complexities of construction lending, laying a solid foundation for project success and long-term financial stability.