Embarking on a business valuation can feel like navigating a complex maze without a map. Whether you are selling your company, planning for a merger, settling a dispute, or simply trying to understand your company’s true worth, a clear framework is absolutely essential. This is where a robust business valuation scope of work template comes into play, providing a structured approach that outlines expectations, responsibilities, and deliverables for both the client and the valuation professional. It’s the blueprint that ensures everyone involved is on the same page from the very beginning.

Without a well-defined scope of work, projects can quickly veer off track, leading to misunderstandings, unexpected costs, and delays. Imagine starting a construction project without architectural plans – the results would be chaotic and likely unsatisfactory. The same principle applies to business valuation. A comprehensive template helps to prevent such pitfalls by clearly articulating the objectives, the methodologies to be employed, and the information required.

This article will guide you through the critical elements of an effective business valuation scope of work template, highlighting why each component is vital for a successful and transparent valuation process. By understanding and utilizing such a template, you can streamline your engagements, ensure clarity, and ultimately achieve more accurate and defensible valuation outcomes.

Understanding the Core Components of a Business Valuation Scope of Work

A well-crafted scope of work is more than just a checklist; it’s a foundational document that sets the stage for the entire valuation engagement. It serves as a mutual agreement, ensuring that both the client and the valuation expert have a shared understanding of what needs to be done, by whom, and when. Getting these details right at the outset is crucial for avoiding complications down the line and achieving a smooth process.

Defining the Purpose and Standard of Value

One of the most critical starting points in any valuation is clearly defining its purpose. Is the valuation for a potential sale of the business, estate planning, divorce proceedings, shareholder disputes, or perhaps for financial reporting? The purpose directly dictates the “standard of value” that will be applied. For instance, a valuation for a sale might focus on “Fair Market Value,” while a valuation for an internal management decision might use “Investment Value.” Specifying this upfront ensures the valuation professional uses the appropriate framework and assumptions, leading to a relevant and accurate result for the intended use.

Identifying the Valuation Date and Report Type

The valuation date is a snapshot in time, representing the specific point at which the business’s value is being assessed. This date is critical because a business’s value can fluctuate significantly due to market conditions, operational changes, or economic events. Equally important is the type of report the client expects. Options typically include a detailed valuation report, a summary report, or a calculation report, each offering different levels of detail, analysis, and assurance, and thus impacting the scope of work and associated fees.

Outlining the Information Gathering Process

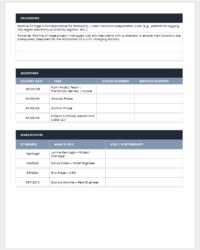

A valuation is only as good as the information it’s based upon. The scope of work should explicitly list the types of documents and data the client is expected to provide. This often includes historical financial statements (income statements, balance sheets, cash flow statements), tax returns, detailed projections, organizational charts, legal documents, material contracts, and information about key personnel, intellectual property, and market conditions. A clear list helps the client prepare and streamlines the data collection phase, avoiding delays.

Methodologies and Approaches to Be Used

While the client might not need a deep dive into valuation theory, the scope of work should generally indicate the approaches and methodologies the valuator intends to use. Common approaches include the asset approach, the income approach (e.g., discounted cash flow), and the market approach (e.g., guideline public company method, transaction method). Stating these upfront provides transparency and allows the client to understand the analytical framework that will be applied to their business.

Deliverables and Client Responsibilities

This section clarifies what the client will receive at the end of the engagement (e.g., a formal written report, a presentation, or both) and in what format. It also reiterates the client’s responsibilities beyond just providing data, such as approving assumptions, responding to inquiries in a timely manner, and facilitating access to management or other key personnel if needed.

Benefits of Utilizing a Clear Business Valuation Scope of Work Template

Adopting a structured approach with a business valuation scope of work template brings a multitude of advantages, not just for the valuation professional but especially for the client. It transforms a potentially ambiguous process into a clear, predictable, and mutually beneficial engagement. The upfront effort in defining the scope significantly reduces the likelihood of future disputes or unmet expectations.

One of the primary benefits is the elimination of ambiguity. By meticulously detailing every aspect of the valuation project, from its purpose to the deliverables, both parties gain a crystal-clear understanding of what the engagement entails. This clarity is invaluable in preventing “scope creep,” where the project expands beyond its initial boundaries without agreement, leading to unforeseen costs and extended timelines. A solid template acts as a reference point, keeping the project focused and aligned with the original objectives.

Furthermore, a well-defined scope enhances trust and professionalism. It demonstrates that the valuation expert is thorough, organized, and committed to transparency. For the client, it provides reassurance that their specific needs and concerns are being addressed systematically. This structured approach fosters a collaborative environment, making the entire valuation journey smoother and more efficient for everyone involved.

Here are some key benefits:

* Ensures mutual understanding of expectations for all parties.

* Prevents scope creep and unexpected costs by clearly defining boundaries.

* Provides a clear roadmap for the entire valuation process, from data collection to final report.

* Facilitates smoother communication between the client and the valuation professional.

* Establishes a professional framework for the engagement, enhancing credibility.

* Minimizes the potential for disputes or misunderstandings throughout the project.

Implementing a clear and comprehensive scope of work from the outset is a cornerstone of a successful business valuation. It acts as the compass guiding the entire process, ensuring that the valuation is not only accurate and defensible but also aligns perfectly with the client’s specific objectives and needs. By investing time in this foundational step, businesses and valuation professionals alike can ensure a streamlined, transparent, and ultimately more rewarding experience. This proactive approach lays the groundwork for accurate insights and confident decision-making regarding a company’s true value.