Embarking on a new client relationship or simply trying to streamline your existing bookkeeping services can often feel like navigating a complex maze without a map. That is precisely why having a clear and comprehensive bookkeeping scope of work template isn’t just a good idea; it’s absolutely essential. It lays the groundwork for expectations, defines deliverables, and ultimately protects both the service provider and the client from misunderstandings down the line.

Without a well-defined scope, you might find yourself in situations where clients expect services you never agreed to provide, leading to frustration, lost time, and potential disputes. This “scope creep” can quickly erode profitability and damage professional relationships, turning what should be a straightforward engagement into a source of stress. It is crucial to set boundaries and articulate exactly what is included in your service package right from the start.

A robust template acts as your guide, ensuring everyone involved is on the same page regarding the tasks to be performed, the frequency of those tasks, and the responsibilities of each party. It transforms vague discussions into concrete agreements, allowing you to deliver exceptional service while maintaining healthy boundaries and a sustainable business model.

Why a Detailed Bookkeeping Scope of Work is Your Best Ally

Think of your bookkeeping scope of work template as the constitution of your client agreement. It’s the foundational document that defines the boundaries and responsibilities for both your business and your client’s. This clarity isn’t just about preventing arguments; it’s about building trust and fostering a professional relationship based on mutual understanding and respect. When expectations are crystal clear, there’s less room for misinterpretation and more space for productive collaboration.

One of the biggest headaches in any service-based business is scope creep – the gradual expansion of a project’s requirements beyond its initially agreed-upon parameters. A detailed scope of work acts as a powerful deterrent. By explicitly listing what services are included and, equally important, what services are not, you create a safeguard against clients incrementally adding tasks without corresponding adjustments to fees or timelines. This ensures you’re fairly compensated for every piece of work you undertake.

Moreover, a well-articulated scope of work is indispensable for accurate pricing. When you know precisely what tasks are involved, how often they need to be performed, and the level of complexity, you can accurately estimate the time and resources required. This leads to more confident and competitive pricing, ensuring that your services are valued appropriately by the market and that your business remains profitable.

Core Bookkeeping Activities

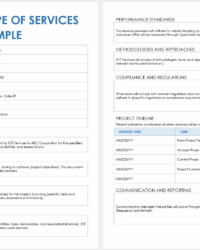

Your template should meticulously detail the core activities you provide. This typically includes transaction categorization and entry, ensuring every financial event is recorded accurately. Bank and credit card reconciliations are another critical component, verifying that all account balances match, identifying any discrepancies, and flagging potential issues. These foundational tasks are the bedrock of reliable financial reporting.

Advanced Services and Exclusions

Beyond the basics, you might offer more advanced services such as accounts payable and accounts receivable management, payroll processing, or even specific financial reporting packages. It’s vital to define these services clearly within your scope. Equally important is the explicit mention of what falls outside the bookkeeping agreement. For instance, tax preparation, financial consulting, or legal advice are typically separate services that require distinct agreements or referrals. Clearly outlining these exclusions manages client expectations effectively.

Finally, a comprehensive scope of work assists greatly in operational efficiency. It serves as a training document for new staff, guiding them on the specific tasks and standards for each client. For ongoing clients, it provides a reference point for periodic reviews, ensuring that the services being delivered align with the original agreement and allowing for proactive adjustments as a client’s needs evolve.

Crafting Your Own Bookkeeping Scope of Work Template

When you set out to create your own bookkeeping scope of work template, start with the fundamentals. Begin by clearly identifying the client, their business name, and the specific period the services will cover. This foundational information ensures that the document is specific to an engagement and can be easily referenced. Think about the overarching goal of the bookkeeping engagement – is it monthly maintenance, clean-up work, or a blend of both? Having this context helps frame the specifics that follow.

Next, you’ll want to dive into the nitty-gritty of the services themselves. This is where you list out, in detail, every task you will perform. Precision is key here; instead of just saying “manage accounts,” specify “categorize and enter all transactions into QuickBooks Online,” or “perform monthly bank reconciliations for up to three accounts.” This level of detail eliminates ambiguity and leaves no room for assumptions.

Don’t forget to define the responsibilities of both parties. A successful bookkeeping partnership relies on clear communication and timely action from both sides. For example, your template should specify that the client is responsible for providing timely access to bank statements, credit card statements, and receipts, while you are responsible for processing those documents within a certain timeframe. This mutual accountability fosters a more efficient and harmonious working relationship.

- Transaction Classification and Entry: Detailed recording of all income and expense transactions.

- Bank and Credit Card Reconciliation: Matching all bank and credit card statement lines to recorded transactions.

- Accounts Payable Management: Tracking and entering vendor bills and scheduling payments.

- Accounts Receivable Management: Creating and sending client invoices, monitoring payments, and following up on overdue accounts.

- Payroll Processing Support: Assisting with payroll data entry and reporting, or integrating with a third-party payroll provider.

- Monthly Financial Reports: Preparation of standard reports such as Profit and Loss statements, Balance Sheets, and Cash Flow statements.

- Communication Cadence: Defining how and when regular communication will occur, e.g., weekly emails, monthly calls.

Adopting a robust scope of work brings immense peace of mind, transforming potentially stressful client engagements into structured, predictable relationships. It empowers you to confidently manage your workload, deliver consistent value, and focus on growing your business without the constant worry of misaligned expectations.

By investing the time to develop and consistently use a comprehensive template, you are not just outlining tasks; you are building a professional foundation for sustainable success. This clear framework allows you to attract the right clients, articulate your value proposition effectively, and ensure every partnership is built on clarity and mutual understanding.