Utilizing such a standardized form streamlines the financing process, ensuring consistent data collection and expediting loan approvals. This benefits both the dealership and the customer by reducing paperwork, minimizing errors, and promoting transparency in the transaction. Furthermore, a standardized approach allows for efficient comparisons of loan offers from different lenders.

This article will explore the key components of these forms, legal considerations surrounding their use, and best practices for implementation within a dealership setting.

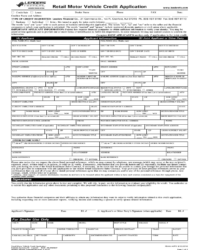

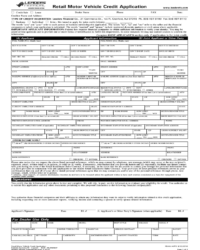

Key Components of a Car Dealer Finance Application

Several essential elements comprise a comprehensive finance application within the automotive retail environment. These components enable lenders to evaluate prospective borrowers and determine the appropriate financing options.

1: Personal Information: Full legal name, current address, contact information, date of birth, and social security number are fundamental identifiers for credit reporting and verification.

2: Employment History: Current and previous employment details, including employer names, addresses, dates of employment, and income verification, demonstrate stability and income potential.

3: Income Details: Gross monthly income, including sources such as salary, wages, investments, and other recurring income streams, are crucial for assessing debt-to-income ratios.

4: Existing Debt Obligations: Information regarding existing loans, credit card balances, and other outstanding debts allows lenders to gauge existing financial burdens and assess risk.

5: Vehicle Information: Details about the vehicle being purchased, including the year, make, model, and VIN, are essential for accurate loan processing and valuation.

6: Trade-in Information (if applicable): If a trade-in vehicle is involved, its details, including year, make, model, and estimated value, are required for accurate assessment of the overall transaction.

7: Desired Financing Terms: Preferred loan term, down payment amount, and desired monthly payment provide insight into the customer’s financial goals and expectations.

8: Authorization and Consent: Signature lines and explicit consent for credit checks and information verification are legally required to proceed with the application process.

Accurate and complete information across these categories ensures a smooth and efficient financing process, facilitating informed decisions for both the lender and the prospective buyer.

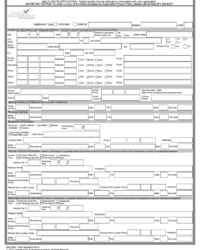

How to Create a Car Dealer Credit Application Template

Developing a robust credit application template is crucial for automotive dealerships. A well-designed template ensures the consistent collection of necessary information, streamlines the financing process, and facilitates informed lending decisions.

1: Define Required Information: Identify essential data points needed for credit evaluation. This includes personal information, employment history, income details, existing debt obligations, vehicle information, and trade-in details (if applicable). Desired financing terms and authorization for credit checks are also crucial.

2: Structure the Template Logically: Organize the template into clear sections. Group related information together to enhance readability and ensure efficient completion by applicants.

3: Use Clear and Concise Language: Employ straightforward language, avoiding jargon or complex terminology. Instructions should be unambiguous, ensuring applicants understand the information requested.

4: Ensure Legal Compliance: Incorporate necessary disclaimers and disclosures related to credit reporting, privacy policies, and applicable state and federal regulations. Consult legal counsel to ensure compliance.

5: Facilitate Digital Completion: Design the template for both printable and digital formats. Digital forms offer increased efficiency, reduced errors, and streamlined data processing.

6: Test and Refine: Pilot test the template with staff and potential customers to identify areas for improvement. Gather feedback on clarity, ease of use, and completeness of information captured.

7: Implement Secure Storage: Establish secure procedures for storing completed applications, both physical and digital, protecting sensitive customer data and complying with privacy regulations.

A comprehensive and well-designed template ensures a smooth and efficient financing process, benefiting both the dealership and its customers. Regular review and updates maintain relevance and compliance within the evolving automotive finance landscape.

Standardized credit application templates within automotive dealerships serve as essential tools for facilitating vehicle financing. They enable consistent data collection, streamline loan processing, and promote transparency between dealerships, customers, and lenders. Understanding the key components of these templates, legal considerations, and best practices for implementation contributes significantly to efficient and compliant financial operations within the dealership environment.

Effective utilization of these templates empowers dealerships to manage the financing process efficiently, fostering positive customer experiences and driving successful vehicle sales. Continued adaptation and refinement of these tools, in accordance with evolving regulations and industry best practices, remains crucial for sustained success in the competitive automotive retail market.