Utilizing a standardized form offers numerous advantages. It ensures all necessary information is gathered, reducing processing time and potential errors. This efficiency benefits both the applicant and the lender. Furthermore, a well-designed form can contribute to a more transparent and equitable lending process.

Understanding the structure and purpose of these forms is crucial for both consumers seeking auto loans and financial professionals involved in the lending process. The following sections will explore the key components typically found within these documents and offer guidance for their effective completion and utilization.

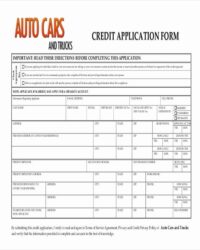

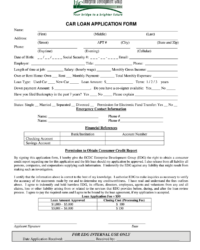

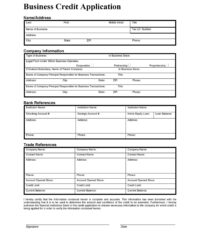

Key Components of a Vehicle Financing Application

Standard vehicle financing applications typically request specific information to assess creditworthiness and determine loan eligibility. Understanding these components is essential for a smooth and efficient application process.

1. Personal Information: This section gathers identifying details such as full name, date of birth, social security number, current address, and contact information. Accurate and complete information is crucial for proper identification and verification.

2. Employment History: Details regarding current and previous employment, including employer names, addresses, dates of employment, and income information, are essential for evaluating income stability and repayment capacity.

3. Financial Information: Applicants typically provide information on existing debts, such as loans and credit cards, as well as assets like bank accounts and investments. This financial overview helps lenders assess debt-to-income ratios and overall financial health.

4. Vehicle Information: Details about the vehicle being financed, including the year, make, model, and vehicle identification number (VIN), are necessary to determine the value and potential collateral for the loan.

5. Loan Information: This section outlines the desired loan amount, preferred loan term, and any potential down payment. This information helps lenders structure a loan that aligns with the applicant’s needs and financial capabilities.

6. Declarations and Authorizations: Applicants typically agree to specific terms and conditions, authorize the lender to verify the provided information, and acknowledge the legal obligations associated with the loan agreement.

Accurate and comprehensive information within these sections allows lenders to evaluate applications efficiently and effectively, leading to more informed lending decisions.

How to Create a Vehicle Credit Application Template

Developing a comprehensive vehicle credit application template requires careful consideration of various elements essential for assessing applicant creditworthiness and ensuring efficient processing. The following steps outline the key components and best practices for creating an effective template.

1. Define the Purpose and Scope: Clearly outline the specific purpose of the application, whether for new or used vehicles, and the types of financing offered. Specify the target audience and any specific requirements or regulations that must be adhered to.

2. Gather Essential Applicant Information: Include fields for personal details (name, address, contact information), employment history (employer name, dates of employment, income), and financial background (assets, liabilities, credit history). Ensure clear instructions are provided for each field.

3. Incorporate Vehicle Details: Designate sections for information about the vehicle being financed, including the year, make, model, VIN, and intended use. Consider including fields for trade-in information if applicable.

4. Specify Loan Details: Include sections for the requested loan amount, desired loan term, down payment amount, and any specific financing preferences. Clearly outline any applicable fees or charges associated with the loan.

5. Include Declarations and Authorizations: Incorporate necessary legal declarations and authorizations for information verification, credit checks, and agreement to the terms and conditions of the application process.

6. Ensure Clarity and Accessibility: Organize the template logically and use clear, concise language. Ensure the form is accessible to all applicants, including those with disabilities. Consider different formats, such as online fillable forms or printable versions.

7. Test and Refine: Before implementing the template, thoroughly test it with representative users to identify any potential issues or areas for improvement. Refine the template based on feedback and ensure it meets all regulatory and legal requirements.

A well-designed template ensures consistency in data collection, streamlines the application process, and facilitates informed lending decisions, benefiting both applicants and financial institutions.

Standardized vehicle credit application templates provide a crucial framework for facilitating efficient and transparent auto loan processes. These templates ensure consistent data collection, enabling lenders to effectively assess applicant creditworthiness and make informed lending decisions. Understanding the key components of these applications, including personal, employment, financial, and vehicle information, is essential for both applicants and lenders. Effective template design prioritizes clarity, accessibility, and adherence to relevant regulations.

By promoting streamlined processes and informed decision-making, robust vehicle credit application templates contribute to a more efficient and equitable automotive financing landscape. As the automotive and financial industries continue to evolve, the strategic utilization of these templates will remain critical for fostering positive lending experiences and supporting responsible vehicle ownership.