Utilizing pre-designed formats offers several advantages. Businesses benefit from improved efficiency in processing applications and reduced administrative overhead. Applicants experience a more transparent and user-friendly process, understanding clearly the information required. Consistent data collection also supports more informed credit assessments and facilitates better risk management.

Further exploration will cover topics such as legal requirements for credit applications in Australia, best practices for designing and implementing these forms, and the role of technology in automating the credit application process. Additional considerations include data security, privacy, and accessibility for all applicants.

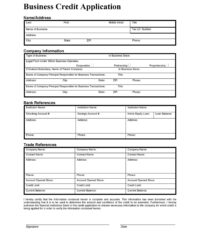

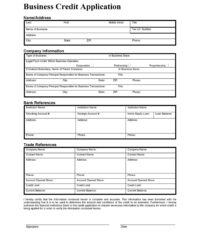

Key Components of a Credit Application Form in Australia

Effective credit application forms gather comprehensive information to facilitate informed credit decisions. Several key components contribute to this objective.

1: Applicant Identification: Full legal name, date of birth, current residential address, and contact details are essential for verifying identity and establishing communication.

2: Employment History: Details regarding current and previous employment, including employer names, dates of employment, and income information, demonstrate financial stability and repayment capacity.

3: Financial Information: Applicants typically provide details of existing financial obligations, such as loans, mortgages, and credit card debts, along with assets and liabilities. This information contributes to a comprehensive understanding of the applicant’s financial position.

4: Credit History: Consent to access credit reports allows businesses to assess past credit behavior and identify any potential risks.

5: Purpose of Credit: Understanding the intended use of credit helps businesses assess the appropriateness of the credit facility and tailor solutions to specific needs.

6: Declarations and Authorizations: Applicants typically declare the accuracy of the information provided and authorize the business to conduct credit checks and verify information. This ensures transparency and compliance with relevant regulations.

A well-designed application form contributes to efficient processing, accurate assessments, and responsible lending practices. Thorough data collection enables businesses to make informed decisions and manage risk effectively.

How to Create a Customer Credit Application Template for Australian Businesses

Developing a robust credit application template requires careful consideration of legal requirements and practical usability. A well-designed template facilitates efficient processing, ensures compliance, and supports informed decision-making.

1: Define Objectives: Clearly outline the purpose of the credit application and the specific information required to assess creditworthiness. Consider the type of credit offered and the target customer segment.

2: Consult Legal Counsel: Ensure compliance with Australian consumer credit legislation and privacy regulations. Seek professional legal advice to incorporate necessary disclosures and obtain informed consent for credit checks.

3: Structure the Template: Organize the form logically, grouping related fields together for ease of completion and review. Use clear headings and concise instructions to guide applicants.

4: Essential Information Fields: Include fields for applicant identification, employment history, financial information, credit history authorization, and purpose of credit. Ensure data collected aligns with assessment criteria.

5: Declarations and Authorizations: Incorporate declarations confirming the accuracy of information provided and authorizing credit checks and information verification. Clearly outline the terms and conditions of the credit agreement.

6: Accessibility and Usability: Design the form with accessibility in mind, considering users with disabilities. Use clear language, appropriate font sizes, and sufficient white space to enhance readability and usability.

7: Testing and Refinement: Pilot test the application form with a representative group to identify any areas for improvement. Refine the template based on feedback and ongoing evaluation.

A comprehensive and legally compliant credit application template forms the foundation of a robust credit assessment process. Regular review and updates are crucial to maintain relevance and adapt to evolving regulatory requirements and business needs.

Effective credit risk management requires a standardized and legally compliant approach to gathering applicant information. Well-designed credit application templates serve as crucial tools for Australian businesses, enabling efficient processing, informed decision-making, and compliance with relevant regulations. Key components such as applicant identification, financial history, credit checks, and declarations ensure thorough due diligence. Accessibility, clear language, and logical structure contribute to a user-friendly experience for applicants.

Adherence to best practices in design and implementation contributes significantly to responsible lending and strengthens the overall financial ecosystem. Regular review and adaptation of templates to reflect evolving regulatory requirements and business needs remain crucial for long-term success. Investing in robust credit application processes fosters trust, protects businesses, and promotes sustainable financial practices within the Australian market.