Utilizing a pre-designed structure streamlines the application process for both the applicant and the supplying business. It reduces errors and omissions by clearly outlining required information, leading to faster approval times. This efficiency translates to quicker onboarding of new clients and improved business relationships. Furthermore, it allows businesses to maintain organized records and easily track applications, promoting better internal management.

This foundation is crucial for understanding the subsequent topics regarding the application process, including specific data requirements, evaluation criteria, and the overall benefits of establishing trade accounts.

Key Components of a Trade Account Application

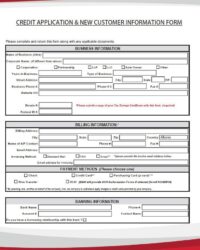

A comprehensive application ensures efficient processing and informed decision-making. Several key data points are typically required to assess the suitability of a potential trade account holder.

1: Business Identification: This section captures essential identifying information, including the legal business name, physical address, mailing address (if different), contact phone numbers, and email address. It establishes the verifiable identity of the applicant business.

2: Business Structure and Ownership: Details regarding the legal structure (e.g., sole proprietorship, partnership, corporation) and ownership information are crucial for understanding the business’s legal standing and financial stability.

3: Financial Information: Applicants typically provide financial data such as bank details, recent financial statements, and credit references. This information allows suppliers to assess creditworthiness and determine appropriate credit limits.

4: Trade References: Contact information for existing suppliers allows verification of the applicant’s payment history and business practices within the industry. This provides valuable insight into their reliability as a trading partner.

5: Intended Purchases: Information regarding the types and estimated volumes of products or services the applicant intends to purchase helps suppliers anticipate demand and tailor their offerings.

6: Resale Information (if applicable): For businesses intending to resell purchased goods, details about their resale operations, including customer base and sales channels, are often required.

Collecting these data points ensures a thorough evaluation of each application, contributing to a sound credit decision process and the establishment of mutually beneficial trade relationships.

How to Create a Trade Account Application Template

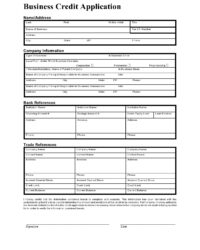

Developing a standardized application template streamlines the onboarding process for new trade customers. A well-designed template ensures consistent data collection, facilitates efficient review, and contributes to informed credit decisions.

1: Define Required Information: Determine the essential data points needed to assess potential trade customers adequately. This typically includes business identification, financial information, trade references, and intended purchase details. Clearly defining these requirements from the outset ensures a comprehensive application process.

2: Structure the Template Logically: Organize the template into clear sections with descriptive headings. A logical flow facilitates easy completion by applicants and simplifies the review process for internal teams.

3: Use Clear and Concise Language: Employ straightforward language to ensure all instructions and questions are easily understood. Avoid ambiguity to minimize errors and omissions in submitted applications.

4: Provide Instructions and Guidance: Include clear instructions for completing each section of the application. Offering guidance on required documentation or specific formatting requirements can further enhance clarity and reduce processing time.

5: Ensure Accessibility and Format: Offer the template in a readily accessible format, such as a downloadable PDF or an online form. Consider design elements that enhance readability and usability, including appropriate font sizes and spacing.

6: Incorporate Legal and Compliance Considerations: Include any necessary legal disclaimers or consent statements to comply with relevant regulations and protect business interests.

7: Test and Refine: Before implementing the template, conduct thorough testing to identify any areas for improvement. Gather feedback from internal users and potential applicants to ensure optimal functionality and clarity.

A well-structured template benefits both the applicant and the business. It simplifies the application process, improves data accuracy, and ultimately contributes to stronger business relationships.

Standardized forms for requesting trade accounts serve as a crucial foundation for business-to-business commerce. These structured documents ensure consistent data collection, enabling efficient assessment of potential clients and contributing to informed credit decisions. Understanding the key components of these applications, including business identification, financial information, and trade references, is essential for both suppliers and applicants. Furthermore, careful template design, incorporating clear language, logical structure, and accessibility considerations, significantly enhances the application process, fostering stronger business relationships built on transparency and efficiency.

Effective management of trade account applications promotes financial stability and sustainable growth within business ecosystems. Implementing streamlined processes and leveraging well-designed templates contribute to a more robust and efficient marketplace. As businesses evolve, adapting these tools to reflect changing industry needs and technological advancements will remain essential for maximizing their value and maintaining a competitive edge.