Utilizing such a form streamlines the application procedure, saving businesses valuable time and effort. A well-crafted form helps present financial information clearly and professionally, increasing the likelihood of a successful outcome. It also ensures all necessary details are included, minimizing the chance of delays due to incomplete submissions. This allows businesses to focus on their core operations while efficiently managing their financing needs.

This article will further explore the key components of these forms, including the information required, best practices for completion, and resources available to New Zealand businesses. Understanding these aspects is crucial for securing the necessary funding to support growth and development.

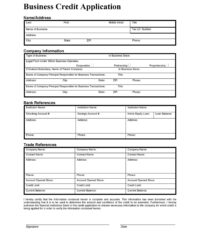

Key Components of a New Zealand Business Credit Application

A comprehensive credit application is essential for securing funding. Several key components ensure lenders receive the necessary information to assess risk and make informed decisions.

1: Company Information: This section typically requires details such as legal business name, trading name, registration number, business address, contact information, and industry sector. Providing accurate and up-to-date information is crucial.

2: Business Background: Lenders often require insights into the business’s history, including its date of establishment, ownership structure, key personnel, and a brief description of its products or services. A clear and concise overview is essential.

3: Financial Information: This is a critical component, often requiring financial statements (profit and loss, balance sheet, cash flow statement) for the past few years. Supporting documentation, such as tax returns and bank statements, may also be requested.

4: Credit Request Details: The application should clearly specify the amount of credit requested, the intended purpose of the funds, and the desired repayment terms. A well-defined purpose strengthens the application.

5: Management Accounts: Up-to-date management accounts provide a snapshot of the companys current financial position. This information is crucial for lenders to assess the businesss ongoing performance.

6: References: Providing trade and bank references allows lenders to verify the businesss creditworthiness and financial stability.

Accurate and complete information, presented professionally, increases the likelihood of a successful application. Each component plays a vital role in presenting a clear and compelling case for funding.

How to Create a Business Credit Application for New Zealand

Developing a robust credit application is crucial for securing necessary funding. A well-structured application facilitates efficient processing and improves the likelihood of approval. The following steps outline the process of creating an effective application tailored to New Zealand businesses.

1: Gather Necessary Information: Compile all relevant business details, including legal structure, registration information, financial history, and ownership details. Ensure all information is accurate and readily accessible.

2: Structure the Application Logically: Organize the application into clear sections: company information, business background, financial data, credit request details, management accounts, and references. A logical structure facilitates efficient review.

3: Include Comprehensive Financial Information: Provide detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements. Include supporting documentation like tax returns and bank statements. Up-to-date management accounts are beneficial.

4: Clearly State the Credit Request: Specify the desired credit amount, the intended use of funds, and preferred repayment terms. A clear and concise request demonstrates a well-defined purpose.

5: Provide Supporting Documentation: Include relevant supporting documents such as business plans, market analysis, and projections. These documents strengthen the application by providing context and demonstrating viability.

6: Review and Refine: Before submission, thoroughly review the application for accuracy, completeness, and clarity. Ensure a professional presentation and consistent formatting.

7: Seek Professional Advice (Optional): Consider consulting with financial advisors or accountants to ensure the application meets industry best practices and accurately reflects the business’s financial position.

A meticulously prepared application reflects professionalism and preparedness, enhancing credibility with lenders and increasing the probability of securing funding.

Access to credit is essential for business growth and development. A well-structured credit application, utilizing a standardized template appropriate for New Zealand businesses, streamlines the process, ensuring lenders receive the necessary information efficiently and effectively. This approach facilitates informed decision-making, reduces processing time, and improves the likelihood of successful funding acquisition. Understanding the key components of these applications, including company information, financial data, and credit request details, empowers businesses to present a compelling case for funding.

Strategic financial planning, coupled with a comprehensive and professionally presented credit application, positions businesses for success in the dynamic New Zealand market. Securing appropriate funding enables businesses to capitalize on opportunities, navigate challenges, and achieve sustainable growth. Thorough preparation and a clear understanding of lending requirements are critical for securing the financial resources necessary to thrive.